It was a rough fourth quarter for many hedge funds, which were naturally unable to overcome the big dip in the broad market, as the S&P 500 fell by about 4.8% during 2018 and average hedge fund losing about 1%. The Russell 2000, composed of smaller companies, performed even worse, trailing the S&P by more than 6 percentage points, as investors fled less-known quantities for safe havens. Luckily hedge funds were shifting their holdings into large-cap stocks. The 20 most popular hedge fund stocks actually generated an average return of 18.7% so far in 2019 and outperformed the S&P 500 ETF by 6.6 percentage points. We are done processing the latest 13f filings and in this article we will study how hedge fund sentiment towards TE Connectivity Ltd. (NYSE:TEL) changed during the first quarter.

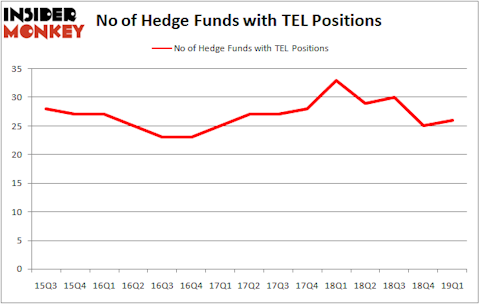

TE Connectivity Ltd. (NYSE:TEL) investors should be aware of an increase in support from the world’s most elite money managers of late. TEL was in 26 hedge funds’ portfolios at the end of the first quarter of 2019. There were 25 hedge funds in our database with TEL positions at the end of the previous quarter. Our calculations also showed that TEL isn’t among the 30 most popular stocks among hedge funds.

According to most investors, hedge funds are assumed to be slow, outdated financial vehicles of the past. While there are over 8000 funds in operation at present, We look at the bigwigs of this group, approximately 750 funds. Most estimates calculate that this group of people shepherd bulk of the smart money’s total asset base, and by keeping track of their finest stock picks, Insider Monkey has determined a number of investment strategies that have historically outpaced Mr. Market. Insider Monkey’s flagship hedge fund strategy exceeded the S&P 500 index by around 5 percentage points a year since its inception in May 2014 through the end of May. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 30.9% since February 2017 (through May 30th) even though the market was up nearly 24% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 11.9% in less than a couple of weeks whereas our long picks outperformed the market by 2 percentage points in this volatile 2 week period.

Let’s view the key hedge fund action regarding TE Connectivity Ltd. (NYSE:TEL).

How are hedge funds trading TE Connectivity Ltd. (NYSE:TEL)?

At the end of the first quarter, a total of 26 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 4% from the previous quarter. By comparison, 33 hedge funds held shares or bullish call options in TEL a year ago. With the smart money’s capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

Among these funds, Generation Investment Management held the most valuable stake in TE Connectivity Ltd. (NYSE:TEL), which was worth $370 million at the end of the first quarter. On the second spot was First Pacific Advisors LLC which amassed $356.7 million worth of shares. Moreover, Impax Asset Management, AQR Capital Management, and Citadel Investment Group were also bullish on TE Connectivity Ltd. (NYSE:TEL), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds have jumped into TE Connectivity Ltd. (NYSE:TEL) headfirst. Citadel Investment Group, managed by Ken Griffin, created the most outsized position in TE Connectivity Ltd. (NYSE:TEL). Citadel Investment Group had $87 million invested in the company at the end of the quarter. Barry Lebovits and Joshua Kuntz’s Rivulet Capital also initiated a $69.3 million position during the quarter. The other funds with new positions in the stock are Bernard Lambilliotte’s Ecofin Ltd, Minhua Zhang’s Weld Capital Management, and Michael Gelband’s ExodusPoint Capital.

Let’s now review hedge fund activity in other stocks similar to TE Connectivity Ltd. (NYSE:TEL). These stocks are Consolidated Edison, Inc. (NYSE:ED), Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (NYSE:TLK), Atlassian Corporation Plc (NASDAQ:TEAM), and Sirius XM Holdings Inc (NASDAQ:SIRI). This group of stocks’ market values are closest to TEL’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ED | 23 | 1182957 | 0 |

| TLK | 9 | 134035 | 3 |

| TEAM | 36 | 1618697 | 2 |

| SIRI | 32 | 1585774 | 11 |

| Average | 25 | 1130366 | 4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 25 hedge funds with bullish positions and the average amount invested in these stocks was $1130 million. That figure was $1247 million in TEL’s case. Atlassian Corporation Plc (NASDAQ:TEAM) is the most popular stock in this table. On the other hand Perusahaan Perseroan (Persero) PT Telekomunikasi Indonesia Tbk (NYSE:TLK) is the least popular one with only 9 bullish hedge fund positions. TE Connectivity Ltd. (NYSE:TEL) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on TEL as the stock returned 8.1% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.