In this article we will take a look at whether hedge funds think TCG BDC, Inc. (NASDAQ:CGBD) is a good investment right now. We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, unconventional data sources, expert networks, and get tips from investment bankers and industry insiders. Sure they sometimes fail miserably, but their consensus stock picks historically outperformed the market after adjusting for known risk factors.

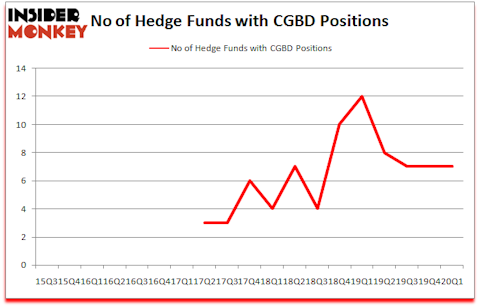

TCG BDC, Inc. (NASDAQ:CGBD) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 7 hedge funds’ portfolios at the end of the first quarter of 2020. At the end of this article we will also compare CGBD to other stocks including Global Partners LP (NYSE:GLP), Clear Channel Outdoor Holdings, Inc. (NYSE:CCO), and Crossamerica Partners LP (NYSE:CAPL) to get a better sense of its popularity.

Video: Watch our video about the top 5 most popular hedge fund stocks.

In the 21st century investor’s toolkit there are a multitude of methods shareholders can use to value publicly traded companies. A couple of the most innovative methods are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the top picks of the top fund managers can outpace the S&P 500 by a superb amount (see the details here).

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out stocks recommended/scorned by legendary Bill Miller. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind let’s view the new hedge fund action encompassing TCG BDC, Inc. (NASDAQ:CGBD).

What have hedge funds been doing with TCG BDC, Inc. (NASDAQ:CGBD)?

At Q1’s end, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 12 hedge funds with a bullish position in CGBD a year ago. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, holds the most valuable position in TCG BDC, Inc. (NASDAQ:CGBD). Arrowstreet Capital has a $6.9 million position in the stock, comprising less than 0.1%% of its 13F portfolio. Coming in second is D E Shaw, led by D. E. Shaw, holding a $2.9 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining members of the smart money that are bullish comprise John Overdeck and David Siegel’s Two Sigma Advisors, Robert B. Gillam’s McKinley Capital Management and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position McKinley Capital Management allocated the biggest weight to TCG BDC, Inc. (NASDAQ:CGBD), around 0.08% of its 13F portfolio. Arrowstreet Capital is also relatively very bullish on the stock, designating 0.02 percent of its 13F equity portfolio to CGBD.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Citadel Investment Group. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Schonfeld Strategic Advisors).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as TCG BDC, Inc. (NASDAQ:CGBD) but similarly valued. We will take a look at Global Partners LP (NYSE:GLP), Clear Channel Outdoor Holdings, Inc. (NYSE:CCO), Crossamerica Partners LP (NYSE:CAPL), and NI Holdings, Inc. (NASDAQ:NODK). This group of stocks’ market caps are similar to CGBD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GLP | 3 | 3868 | -1 |

| CCO | 33 | 83014 | -9 |

| CAPL | 1 | 283 | 0 |

| NODK | 6 | 21289 | -1 |

| Average | 10.75 | 27114 | -2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.75 hedge funds with bullish positions and the average amount invested in these stocks was $27 million. That figure was $15 million in CGBD’s case. Clear Channel Outdoor Holdings, Inc. (NYSE:CCO) is the most popular stock in this table. On the other hand Crossamerica Partners LP (NYSE:CAPL) is the least popular one with only 1 bullish hedge fund positions. TCG BDC, Inc. (NASDAQ:CGBD) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 13.9% in 2020 through June 10th and still beat the market by 14.2 percentage points. A small number of hedge funds were also right about betting on CGBD as the stock returned 80.7% during the second quarter and outperformed the market by an even larger margin.

Follow Carlyle Secured Lending Inc. (NASDAQ:CGBD)

Follow Carlyle Secured Lending Inc. (NASDAQ:CGBD)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.