Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Summit Hotel Properties Inc (NYSE:INN).

Is Summit Hotel Properties Inc (NYSE:INN) the right pick for your portfolio? Investors who are in the know are betting on the stock. The number of long hedge fund positions moved up by 2 lately. Our calculations also showed that inn isn’t among the 30 most popular stocks among hedge funds.

According to most stock holders, hedge funds are perceived as slow, outdated investment vehicles of years past. While there are greater than 8,000 funds trading today, Our researchers hone in on the masters of this club, about 700 funds. Most estimates calculate that this group of people have their hands on the majority of the hedge fund industry’s total asset base, and by watching their unrivaled stock picks, Insider Monkey has unsheathed a few investment strategies that have historically outrun the S&P 500 index. Insider Monkey’s flagship hedge fund strategy outpaced the S&P 500 index by 6 percentage points per annum since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

We’re going to take a look at the key hedge fund action encompassing Summit Hotel Properties Inc (NYSE:INN).

What does the smart money think about Summit Hotel Properties Inc (NYSE:INN)?

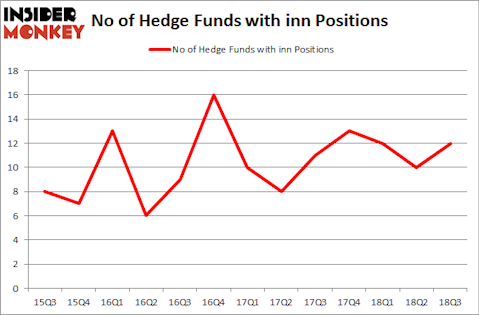

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 20% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards INN over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Millennium Management held the most valuable stake in Summit Hotel Properties Inc (NYSE:INN), which was worth $13.8 million at the end of the third quarter. On the second spot was Balyasny Asset Management which amassed $3.7 million worth of shares. Moreover, D E Shaw, Fisher Asset Management, and Highland Capital Management were also bullish on Summit Hotel Properties Inc (NYSE:INN), allocating a large percentage of their portfolios to this stock.

With a general bullishness amongst the heavyweights, specific money managers were breaking ground themselves. D E Shaw, managed by D. E. Shaw, established the biggest position in Summit Hotel Properties Inc (NYSE:INN). D E Shaw had $1.2 million invested in the company at the end of the quarter. James Dondero’s Highland Capital Management also initiated a $0.6 million position during the quarter. The only other fund with a brand new INN position is Paul Marshall and Ian Wace’s Marshall Wace LLP.

Let’s now review hedge fund activity in other stocks similar to Summit Hotel Properties Inc (NYSE:INN). We will take a look at Abercrombie & Fitch Co. (NYSE:ANF), AxoGen, Inc. (NASDAQ:AXGN), Ferroglobe PLC (NASDAQ:GSM), and ImmunoGen, Inc. (NASDAQ:IMGN). This group of stocks’ market valuations are similar to INN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ANF | 20 | 168236 | 0 |

| AXGN | 21 | 170982 | -1 |

| GSM | 17 | 164584 | 0 |

| IMGN | 18 | 288017 | 5 |

| Average | 19 | 197955 | 1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19 hedge funds with bullish positions and the average amount invested in these stocks was $198 million. That figure was $23 million in INN’s case. AxoGen, Inc. (NASDAQ:AXGN) is the most popular stock in this table. On the other hand Ferroglobe PLC (NASDAQ:GSM) is the least popular one with only 17 bullish hedge fund positions. Compared to these stocks Summit Hotel Properties Inc (NYSE:INN) is even less popular than GSM. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.