Hedge fund managers like David Einhorn, Bill Ackman, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: SP Plus Corp (NASDAQ:SP).

Hedge fund interest in SP Plus Corp (NASDAQ:SP) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare SP to other stocks including Ituran Location and Control Ltd. (US) (NASDAQ:ITRN), Dicerna Pharmaceuticals Inc (NASDAQ:DRNA), and Oritani Financial Corp. (NASDAQ:ORIT) to get a better sense of its popularity.

Today there are tons of tools investors have at their disposal to appraise stocks. A couple of the most underrated tools are hedge fund and insider trading interest. We have shown that, historically, those who follow the top picks of the elite money managers can outpace the market by a healthy amount (see the details here).

Let’s review the key hedge fund action regarding SP Plus Corp (NASDAQ:SP).

How have hedgies been trading SP Plus Corp (NASDAQ:SP)?

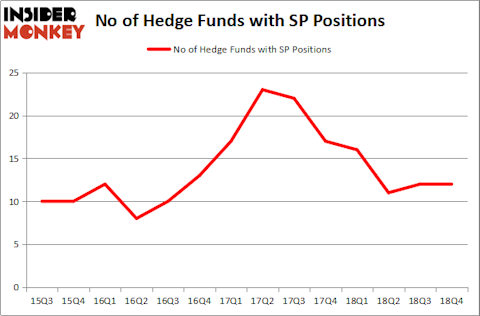

At the end of the fourth quarter, a total of 12 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SP over the last 14 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in SP Plus Corp (NASDAQ:SP) was held by P2 Capital Partners, which reported holding $33.4 million worth of stock at the end of December. It was followed by Renaissance Technologies with a $14.5 million position. Other investors bullish on the company included Lionstone Capital Management, AQR Capital Management, and Marshall Wace LLP.

Seeing as SP Plus Corp (NASDAQ:SP) has witnessed bearish sentiment from the aggregate hedge fund industry, it’s easy to see that there were a few funds that slashed their positions entirely heading into Q3. It’s worth mentioning that Martin Whitman’s Third Avenue Management sold off the biggest stake of the 700 funds watched by Insider Monkey, comprising close to $6.1 million in stock, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital was right behind this move, as the fund sold off about $0.8 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as SP Plus Corp (NASDAQ:SP) but similarly valued. We will take a look at Ituran Location and Control Ltd. (US) (NASDAQ:ITRN), Dicerna Pharmaceuticals Inc (NASDAQ:DRNA), Oritani Financial Corp. (NASDAQ:ORIT), and Northfield Bancorp Inc (NASDAQ:NFBK). This group of stocks’ market valuations are similar to SP’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ITRN | 9 | 106305 | -1 |

| DRNA | 20 | 247563 | 0 |

| ORIT | 8 | 39598 | 0 |

| NFBK | 4 | 29496 | 1 |

| Average | 10.25 | 105741 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $106 million. That figure was $90 million in SP’s case. Dicerna Pharmaceuticals Inc (NASDAQ:DRNA) is the most popular stock in this table. On the other hand Northfield Bancorp Inc (NASDAQ:NFBK) is the least popular one with only 4 bullish hedge fund positions. SP Plus Corp (NASDAQ:SP) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on SP, though not to the same extent, as the stock returned 16.7% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.