Investing in hedge funds can bring large profits, but it’s not for everybody, since hedge funds are available only for high-net-worth individuals. They generate significant returns for investors to justify their large fees and they allocate a lot of time and employ a complex analysis to determine the best stocks to invest in. A particularly interesting group of stocks that hedge funds like is the small-caps. The huge amount of capital does not allow hedge funds to invest a lot in small-caps, but our research showed that their most popular small-cap ideas are less efficiently priced and generate stronger returns than their large- and mega-cap picks and the broader market. That is why we follow the hedge fund activity in the small-cap space.

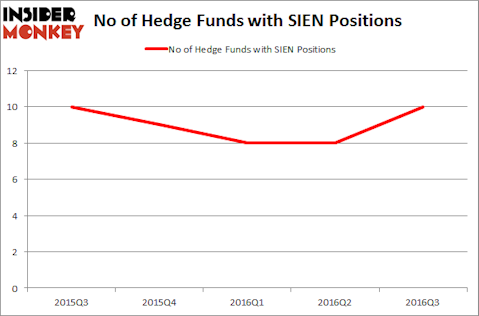

Sientra Inc (NASDAQ:SIEN) has experienced an increase in hedge fund interest in recent months. SIEN was in 10 hedge funds’ portfolios at the end of September. There were 8 hedge funds in our database with SIEN positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as RealNetworks Inc (NASDAQ:RNWK), Orrstown Financial Services (NASDAQ:ORRF), and Garrison Capital Inc (NASDAQ:GARS) to gather more data points.

Follow Sientra Inc. (NASDAQ:SIEN)

Follow Sientra Inc. (NASDAQ:SIEN)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Andrei Rahalski/Shutterstock.com

With all of this in mind, let’s check out the key action regarding Sientra Inc (NASDAQ:SIEN).

What does the smart money think about Sientra Inc (NASDAQ:SIEN)?

Heading into the fourth quarter of 2016, a total of 10 of the hedge funds tracked by Insider Monkey were long this stock, up 25% from the previous quarter. On the other hand, there were a total of 9 hedge funds with a bullish position in SIEN at the beginning of this year. With hedgies’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Peter S. Park’s Park West Asset Management has the number one position in Sientra Inc (NASDAQ:SIEN), worth close to $15.1 million, corresponding to 1.4% of its total 13F portfolio. On Park West Asset Management’s heels is OrbiMed Advisors, led by Samuel Isaly, which holds a $8.2 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions contain J. Carlo Cannell’s Cannell Capital, Efrem Kamen’s Pura Vida Investments and Millennium Management, one of the 10 largest hedge funds in the world. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As aggregate interest increased, key hedge funds have jumped into Sientra Inc (NASDAQ:SIEN) headfirst. Jim Simons’ Renaissance Technologies initiated the most valuable position in Sientra Inc (NASDAQ:SIEN). According to regulatory filings, the fund had $0.7 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $0.1 million position during the quarter. The only other fund with a new position in the stock is D. E. Shaw’s D E Shaw.

Let’s check out hedge fund activity in other stocks similar to Sientra Inc (NASDAQ:SIEN). We will take a look at RealNetworks Inc (NASDAQ:RNWK), Orrstown Financial Services (NASDAQ:ORRF), Garrison Capital Inc (NASDAQ:GARS), and Alexco Resource Corp. (USA) (NYSEAMEX:AXU). This group of stocks’ market valuations are closest to SIEN’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| RNWK | 5 | 44999 | 0 |

| ORRF | 3 | 20541 | 0 |

| GARS | 3 | 1164 | -1 |

| AXU | 4 | 2415 | 4 |

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $17 million. That figure was $42 million in SIEN’s case. RealNetworks Inc (NASDAQ:RNWK) is the most popular stock in this table. On the other hand Orrstown Financial Services (NASDAQ:ORRF) is the least popular one with only 3 bullish hedge fund positions. Compared to these stocks Sientra Inc (NASDAQ:SIEN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None