Hedge fund managers like David Einhorn, Dan Loeb, or Carl Icahn became billionaires through reaping large profits for their investors, which is why piggybacking their stock picks may provide us with significant returns as well. Many hedge funds, like Paul Singer’s Elliott Management, are pretty secretive, but we can still get some insights by analyzing their quarterly 13F filings. One of the most fertile grounds for large abnormal returns is hedge funds’ most popular small-cap picks, which are not so widely followed and often trade at a discount to their intrinsic value. In this article we will check out hedge fund activity in another small-cap stock: Sibanye Gold Ltd (ADR) (NYSE:SBGL).

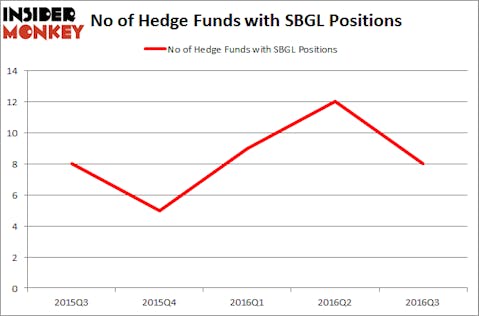

Sibanye Gold Ltd (ADR) (NYSE:SBGL) investors should pay attention to a decrease in activity from the world’s largest hedge funds recently. There were 8 hedge funds in our database with SBGL holdings at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Apple Hospitality REIT Inc (NYSE:APLE), ONE Gas Inc (NYSE:OGS), and Hawaiian Electric Industries, Inc. (NYSE:HE) to gather more data points.

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

solarseven/Shutterstock.com

How have hedgies been trading Sibanye Gold Ltd (ADR) (NYSE:SBGL)?

At the end of the third quarter, a total of 8 of the hedge funds tracked by Insider Monkey were long this stock, down by 33% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards SBGL over the last 5 quarters. With the smart money’s capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital has the largest position in Sibanye Gold Ltd (ADR) (NYSE:SBGL), worth close to $10.6 million. The second largest stake is held by Renaissance Technologies, one of the largest hedge funds in the world, holding a $3.8 million position. Some other professional money managers that hold long positions comprise Ray Dalio’s Bridgewater Associates, David Costen Haley’s HBK Investments and Cliff Asness’ AQR Capital Management. We should note that Bridgewater Associates is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We already know that not all hedge funds are bullish on the stock and some hedge funds actually got rid of their positions entirely. It’s worth mentioning that Phill Gross and Robert Atchinson’s Adage Capital Management got rid of the largest stake of all the investors followed by Insider Monkey, comprising an estimated $23.2 million in stock. Kurt Billick’s fund, Bocage Capital, also cut its stock, about $9.2 million worth.

Let’s now review hedge fund activity in other stocks similar to Sibanye Gold Ltd (ADR) (NYSE:SBGL). We will take a look at Apple Hospitality REIT Inc (NYSE:APLE), ONE Gas Inc (NYSE:OGS), Hawaiian Electric Industries, Inc. (NYSE:HE), and Snyder S Lance Inc (NASDAQ:LNCE). All of these stocks’ market caps are similar to SBGL’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| APLE | 11 | 27793 | 4 |

| OGS | 11 | 66906 | -1 |

| HE | 13 | 117484 | 2 |

| LNCE | 8 | 136348 | -2 |

As you can see these stocks had an average of 11 hedge funds with bullish positions and the average amount invested in these stocks was $87 million. That figure was $21 million in SBGL’s case. Hawaiian Electric Industries, Inc. (NYSE:HE) is the most popular stock in this table. On the other hand Snyder S Lance Inc (NASDAQ:LNCE) is the least popular one with only 8 bullish hedge fund positions. Compared to these stocks Sibanye Gold Ltd (ADR) (NYSE:SBGL) is even less popular than LNCE. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None