A whopping number of 13F filings filed with U.S. Securities and Exchange Commission has been processed by Insider Monkey so that individual investors can look at the overall hedge fund sentiment towards the stocks included in their watchlists. These freshly-submitted public filings disclose money managers’ equity positions as of the end of the three-month period that ended September 30, so let’s proceed with the discussion of the hedge fund sentiment on Shutterfly, Inc. (NASDAQ:SFLY).

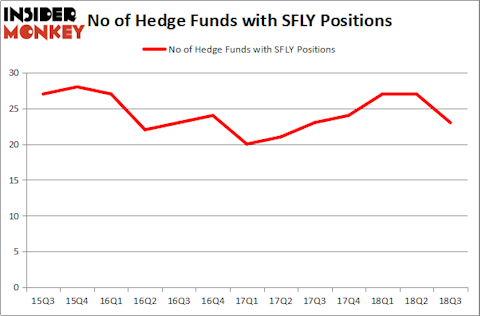

Is Shutterfly, Inc. (NASDAQ:SFLY) a marvelous investment today? Investors who are in the know are in a bearish mood. The number of long hedge fund positions retreated by 4 recently. Our calculations also showed that SFLY isn’t among the 30 most popular stocks among hedge funds. SFLY was in 23 hedge funds’ portfolios at the end of September. There were 27 hedge funds in our database with SFLY holdings at the end of the previous quarter.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the latest hedge fund action encompassing Shutterfly, Inc. (NASDAQ:SFLY).

What does the smart money think about Shutterfly, Inc. (NASDAQ:SFLY)?

At the end of the third quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, a change of -15% from one quarter earlier. By comparison, 24 hedge funds held shares or bullish call options in SFLY heading into this year. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Amish Mehta’s SQN Investors has the largest position in Shutterfly, Inc. (NASDAQ:SFLY), worth close to $104.2 million, amounting to 10.1% of its total 13F portfolio. Sitting at the No. 2 spot is Peter S. Park of Park West Asset Management, with a $98.8 million call position; the fund has 3.6% of its 13F portfolio invested in the stock. Remaining professional money managers that are bullish encompass Peter S. Park’s Park West Asset Management, Adam Wolfberg and Steven Landry’s EastBay Asset Management and Michael Doheny’s Freshford Capital Management.

Since Shutterfly, Inc. (NASDAQ:SFLY) has experienced bearish sentiment from the smart money, logic holds that there were a few fund managers that elected to cut their positions entirely heading into Q3. At the top of the heap, Jim Simons’s Renaissance Technologies dropped the biggest position of all the hedgies watched by Insider Monkey, comprising close to $85.4 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also dumped its stock, about $69.8 million worth. These moves are interesting, as total hedge fund interest dropped by 4 funds heading into Q3.

Let’s go over hedge fund activity in other stocks similar to Shutterfly, Inc. (NASDAQ:SFLY). These stocks are Terreno Realty Corporation (NYSE:TRNO), Cadence Bancorporation (NYSE:CADE), QTS Realty Trust Inc (NYSE:QTS), and Universal Forest Products, Inc. (NASDAQ:UFPI). All of these stocks’ market caps match SFLY’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TRNO | 12 | 62944 | 3 |

| CADE | 19 | 323041 | 3 |

| QTS | 19 | 393861 | 6 |

| UFPI | 18 | 79274 | 1 |

| Average | 17 | 214780 | 3.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $215 million. That figure was $550 million in SFLY’s case. Cadence Bancorporation (NYSE:CADE) is the most popular stock in this table. On the other hand Terreno Realty Corporation (NYSE:TRNO) is the least popular one with only 12 bullish hedge fund positions. Compared to these stocks Shutterfly, Inc. (NASDAQ:SFLY) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.