At Insider Monkey we follow around 700 of the best-performing investors and even though many of them lost money in the last couple of months (70% of hedge funds lost money in October whereas S&P 500 ETF lost about 7%), the history teaches us that over the long-run they still manage to beat the market, which is why it can be profitable for us to imitate their activity. Of course, even the best money managers can sometimes get it wrong, but following some of their picks gives us a better chance to outperform the crowd than picking a random stock and this is where our research comes in.

SEI Investments Company (NASDAQ:SEIC) investors should be aware of an increase in enthusiasm from smart money lately. SEIC was in 24 hedge funds’ portfolios at the end of the third quarter of 2018. There were 22 hedge funds in our database with SEIC holdings at the end of the previous quarter. Our calculations also showed that SEIC isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are tons of metrics stock traders employ to grade stocks. A pair of the best metrics are hedge fund and insider trading interest. We have shown that, historically, those who follow the best picks of the top investment managers can outclass the market by a solid margin (see the details here).

We’re going to take a glance at the key hedge fund action regarding SEI Investments Company (NASDAQ:SEIC).

Hedge fund activity in SEI Investments Company (NASDAQ:SEIC)

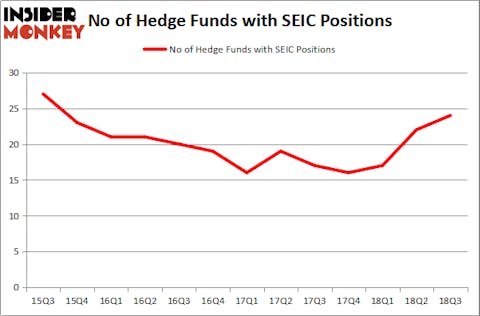

Heading into the fourth quarter of 2018, a total of 24 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 9% from the previous quarter. The graph below displays the number of hedge funds with bullish position in SEIC over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Arrowstreet Capital was the largest shareholder of SEI Investments Company (NASDAQ:SEIC), with a stake worth $98.1 million reported as of the end of September. Trailing Arrowstreet Capital was Millennium Management, which amassed a stake valued at $43.7 million. AQR Capital Management, Royce & Associates, and Balyasny Asset Management were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key hedge funds have jumped into SEI Investments Company (NASDAQ:SEIC) headfirst. HBK Investments, managed by David Costen Haley, created the biggest position in SEI Investments Company (NASDAQ:SEIC). HBK Investments had $1.1 million invested in the company at the end of the quarter. Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital also initiated a $0 million position during the quarter.

Let’s also examine hedge fund activity in other stocks similar to SEI Investments Company (NASDAQ:SEIC). We will take a look at Lear Corporation (NYSE:LEA), Zebra Technologies Corporation (NASDAQ:ZBRA), Avery Dennison Corporation (NYSE:AVY), and Tyler Technologies, Inc. (NYSE:TYL). This group of stocks’ market valuations are similar to SEIC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LEA | 34 | 845180 | 2 |

| ZBRA | 27 | 893057 | -5 |

| AVY | 29 | 462957 | 3 |

| TYL | 22 | 752257 | 2 |

| Average | 28 | 738363 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28 hedge funds with bullish positions and the average amount invested in these stocks was $738 million. That figure was $361 million in SEIC’s case. Lear Corporation (NYSE:LEA) is the most popular stock in this table. On the other hand Tyler Technologies, Inc. (NYSE:TYL) is the least popular one with only 22 bullish hedge fund positions. SEI Investments Company (NASDAQ:SEIC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard LEA might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.