Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed over the past few years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that hedge funds do have great stock picking skills, so let’s take a glance at the smart money sentiment towards SBA Communications Corporation (NASDAQ:SBAC).

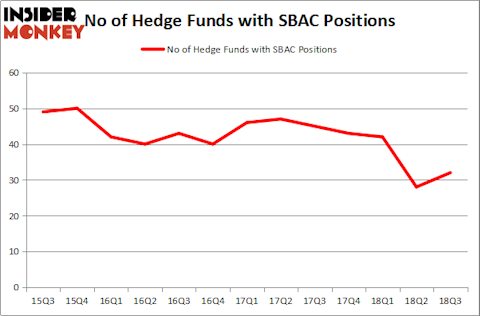

SBA Communications Corporation (NASDAQ:SBAC) was in 32 hedge funds’ portfolios at the end of September. SBAC shareholders have witnessed an increase in enthusiasm from smart money lately. There were 28 hedge funds in our database with SBAC positions at the end of the previous quarter. Our calculations also showed that SBAC isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the fresh hedge fund action surrounding SBA Communications Corporation (NASDAQ:SBAC).

What does the smart money think about SBA Communications Corporation (NASDAQ:SBAC)?

Heading into the fourth quarter of 2018, a total of 32 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 14% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards SBAC over the last 13 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Charles Akre’s Akre Capital Management has the largest position in SBA Communications Corporation (NASDAQ:SBAC), worth close to $396 million, comprising 4.6% of its total 13F portfolio. On Akre Capital Management’s heels is Citadel Investment Group, led by Ken Griffin, holding a $268.5 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions contain Jim Simons’s Renaissance Technologies, D. E. Shaw’s D E Shaw and Sharlyn C. Heslam’s Stockbridge Partners.

With a general bullishness amongst the heavyweights, some big names have jumped into SBA Communications Corporation (NASDAQ:SBAC) headfirst. Balyasny Asset Management, managed by Dmitry Balyasny, initiated the most outsized position in SBA Communications Corporation (NASDAQ:SBAC). Balyasny Asset Management had $33.4 million invested in the company at the end of the quarter. Steve Cohen’s Point72 Asset Management also initiated a $16.1 million position during the quarter. The following funds were also among the new SBAC investors: Kelly Hampaul’s Everett Capital Advisors, Paul Tudor Jones’s Tudor Investment Corp, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as SBA Communications Corporation (NASDAQ:SBAC) but similarly valued. We will take a look at Willis Towers Watson Public Limited Company (NASDAQ:WLTW), Citizens Financial Group Inc (NYSE:CFG), AMETEK, Inc. (NYSE:AME), and Apache Corporation (NYSE:APA). This group of stocks’ market valuations are similar to SBAC’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| WLTW | 33 | 2052314 | 7 |

| CFG | 42 | 1556600 | -5 |

| AME | 33 | 1185675 | -4 |

| APA | 26 | 882116 | 9 |

| Average | 33.5 | 1419176 | 1.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 33.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.42 billion. That figure was $1.85 billion in SBAC’s case. Citizens Financial Group Inc (NYSE:CFG) is the most popular stock in this table. On the other hand Apache Corporation (NYSE:APA) is the least popular one with only 26 bullish hedge fund positions. SBA Communications Corporation (NASDAQ:SBAC) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CFG might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.