The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors experienced strong gains on the back of a strong market performance, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Sabine Royalty Trust (NYSE:SBR).

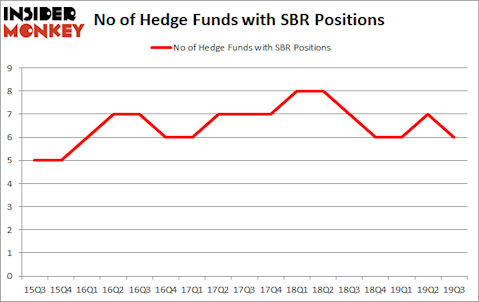

Sabine Royalty Trust (NYSE:SBR) has seen a decrease in enthusiasm from smart money lately. Our calculations also showed that SBR isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most market participants, hedge funds are viewed as slow, outdated financial vehicles of the past. While there are greater than 8000 funds in operation today, We hone in on the crème de la crème of this club, around 750 funds. These money managers preside over the majority of the smart money’s total capital, and by shadowing their top investments, Insider Monkey has found numerous investment strategies that have historically outpaced the S&P 500 index. Insider Monkey’s flagship short hedge fund strategy defeated the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Chuck Royce of Royce & Associates

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind let’s take a glance at the latest hedge fund action regarding Sabine Royalty Trust (NYSE:SBR).

What does smart money think about Sabine Royalty Trust (NYSE:SBR)?

At the end of the third quarter, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from the second quarter of 2019. On the other hand, there were a total of 7 hedge funds with a bullish position in SBR a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

The largest stake in Sabine Royalty Trust (NYSE:SBR) was held by Wildcat Capital Management, which reported holding $14.5 million worth of stock at the end of September. It was followed by Royce & Associates with a $3 million position. Other investors bullish on the company included Lucas Capital Management, Arrowstreet Capital, and Horizon Asset Management. In terms of the portfolio weights assigned to each position Wildcat Capital Management allocated the biggest weight to Sabine Royalty Trust (NYSE:SBR), around 6.15% of its 13F portfolio. Lucas Capital Management is also relatively very bullish on the stock, setting aside 2.31 percent of its 13F equity portfolio to SBR.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Renaissance Technologies. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because none of the 750+ hedge funds tracked by Insider Monkey identified SBR as a viable investment and initiated a position in the stock.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Sabine Royalty Trust (NYSE:SBR) but similarly valued. We will take a look at Fossil Group Inc (NASDAQ:FOSL), Tidewater Inc. (NYSE:TDW), Malibu Boats Inc (NASDAQ:MBUU), and Niu Technologies (NASDAQ:NIU). This group of stocks’ market valuations resemble SBR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FOSL | 18 | 77372 | 5 |

| TDW | 17 | 145340 | 2 |

| MBUU | 20 | 81462 | 3 |

| NIU | 5 | 36234 | -1 |

| Average | 15 | 85102 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $85 million. That figure was $23 million in SBR’s case. Malibu Boats Inc (NASDAQ:MBUU) is the most popular stock in this table. On the other hand Niu Technologies (NASDAQ:NIU) is the least popular one with only 5 bullish hedge fund positions. Sabine Royalty Trust (NYSE:SBR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately SBR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); SBR investors were disappointed as the stock returned -6.6% during the first two months of the fourth quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market in Q4.

Disclosure: None. This article was originally published at Insider Monkey.