We know that hedge funds generate strong risk-adjusted returns over the long run, therefore imitating the picks that they are collectively bullish on can be a profitable strategy for retail investors. With billions of dollars in assets, smart money investors have to conduct complex analyses, spend many resources and use tools that are not always available for the general crowd. This doesn’t mean that they don’t have occasional colossal losses; they do (like Ackman’s recent Valeant losses). However, it is still good idea to keep an eye on hedge fund activity. With this in mind, as the current round of 13F filings has just ended, let’s examine the smart money sentiment towards Rockwell Collins, Inc. (NYSE:COL) .

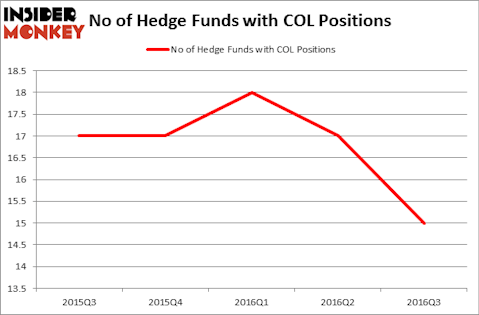

Rockwell Collins, Inc. (NYSE:COL) investors should be aware of a decrease in activity from the world’s largest hedge funds recently. There were 15 hedge funds in our database with COL holdings at the end of the 2016 third quarter. At the end of this article we will also compare COL to other stocks including Lincoln National Corporation (NYSE:LNC), LKQ Corporation (NASDAQ:LKQ), and KLA-Tencor Corporation (NASDAQ:KLAC) to get a better sense of its popularity.

Follow Rockwell Collins Inc (NYSE:COL)

Follow Rockwell Collins Inc (NYSE:COL)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Now, we’re going to take a look at the key action regarding Rockwell Collins, Inc. (NYSE:COL).

What have hedge funds been doing with Rockwell Collins, Inc. (NYSE:COL)?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 12% from one quarter earlier. On the other hand, there were a total of 17 hedge funds with a bullish position in COL at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of key hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, John W. Rogers of Ariel Investments holds the biggest position in Rockwell Collins, Inc. (NYSE:COL), which has reported a $50.2 million stake in the company at the end of the third quarter. The second largest stake is held by Ken Griffin’s Citadel Investment Group, which has a $40.5 million position. Remaining professional money managers that hold long positions include D. E. Shaw’s D E Shaw, Jim Simons’ Renaissance Technologies and David Harding’s Winton Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Seeing as Rockwell Collins, Inc. (NYSE:COL) has sustained bearish sentiment from the aggregate hedge fund industry, it’s safe to say that there lies a certain “tier” of hedgies that decided to sell off their positions entirely heading into Q4. Interestingly, Israel Englander’s Millennium Management dumped the biggest position of the “upper crust” of funds watched by Insider Monkey, worth about $6.6 million in stock. Bruce Kovner’s fund, Caxton Associates LP, also cut its stock, about $6 million worth of COL shares.

Let’s go over hedge fund activity in other stocks similar to Rockwell Collins, Inc. (NYSE:COL). These stocks are Lincoln National Corporation (NYSE:LNC), LKQ Corporation (NASDAQ:LKQ), KLA-Tencor Corporation (NASDAQ:KLAC), and Fiat Chrysler Automobiles NV (NYSE:FCAU). This group of stocks’ market valuations resemble COL’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LNC | 24 | 668282 | 0 |

| LKQ | 32 | 668630 | 2 |

| KLAC | 46 | 968361 | 16 |

| FCAU | 31 | 717458 | 4 |

As you can see these stocks had an average of 33 hedge funds with bullish positions and the average amount invested in these stocks was $756 million. That figure was $186 million in COL’s case. KLA-Tencor Corporation (NASDAQ:KLAC) is the most popular stock in this table. On the other hand Lincoln National Corporation (NYSE:LNC) is the least popular one with only 24 bullish hedge fund positions. Compared to these stocks Rockwell Collins, Inc. (NYSE:COL) is even less popular than LNC. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None