As we already know from media reports and hedge fund investor letters, hedge funds delivered their best returns in a decade. Most investors who decided to stick with hedge funds after a rough 2018 recouped their losses by the end of the fourth quarter of 2019. A significant number of hedge funds continued their strong performance in 2020 and 2021 as well. We get to see hedge funds’ thoughts towards the market and individual stocks by aggregating their quarterly portfolio movements and reading their investor letters. In this article, we will particularly take a look at what hedge funds think about PNM Resources, Inc. (NYSE:PNM).

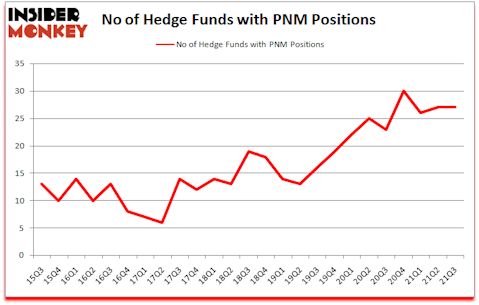

Hedge fund interest in PNM Resources, Inc. (NYSE:PNM) shares was flat at the end of last quarter. This is usually a negative indicator. Our calculations also showed that PNM isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings). The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Silgan Holdings Inc. (NASDAQ:SLGN), Avient Corporation (NYSE:AVNT), and Sana Biotechnology, Inc. (NASDAQ:SANA) to gather more data points.

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium prices have more than doubled over the past year, so we go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. Now we’re going to take a peek at the fresh hedge fund action encompassing PNM Resources, Inc. (NYSE:PNM).

Mario Gabelli of GAMCO Investors

Do Hedge Funds Think PNM Is A Good Stock To Buy Now?

At third quarter’s end, a total of 27 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the second quarter of 2021. By comparison, 23 hedge funds held shares or bullish call options in PNM a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in PNM Resources, Inc. (NYSE:PNM) was held by Millennium Management, which reported holding $168.3 million worth of stock at the end of September. It was followed by Magnetar Capital with a $140.9 million position. Other investors bullish on the company included Citadel Investment Group, GAMCO Investors, and Melqart Asset Management. In terms of the portfolio weights assigned to each position Ovata Capital Management allocated the biggest weight to PNM Resources, Inc. (NYSE:PNM), around 3.59% of its 13F portfolio. Melqart Asset Management is also relatively very bullish on the stock, earmarking 2.47 percent of its 13F equity portfolio to PNM.

Seeing as PNM Resources, Inc. (NYSE:PNM) has experienced falling interest from the aggregate hedge fund industry, we can see that there were a few hedge funds who sold off their positions entirely heading into Q4. Intriguingly, Orkun Kilic’s Berry Street Capital dropped the largest stake of the “upper crust” of funds followed by Insider Monkey, totaling close to $21.9 million in stock, and Phill Gross and Robert Atchinson’s Adage Capital Management was right behind this move, as the fund said goodbye to about $10.8 million worth. These transactions are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks similar to PNM Resources, Inc. (NYSE:PNM). We will take a look at Silgan Holdings Inc. (NASDAQ:SLGN), Avient Corporation (NYSE:AVNT), Sana Biotechnology, Inc. (NASDAQ:SANA), ServisFirst Bancshares, Inc. (NYSE:SFBS), Radian Group Inc (NYSE:RDN), LivaNova PLC (NASDAQ:LIVN), and UFP Industries, Inc. (NASDAQ:UFPI). This group of stocks’ market valuations match PNM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLGN | 14 | 209953 | 1 |

| AVNT | 17 | 93956 | -3 |

| SANA | 7 | 94892 | -3 |

| SFBS | 8 | 11248 | -2 |

| RDN | 27 | 380409 | -3 |

| LIVN | 32 | 1140452 | -4 |

| UFPI | 17 | 143498 | 4 |

| Average | 17.4 | 296344 | -1.4 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.4 hedge funds with bullish positions and the average amount invested in these stocks was $296 million. That figure was $718 million in PNM’s case. LivaNova PLC (NASDAQ:LIVN) is the most popular stock in this table. On the other hand Sana Biotechnology, Inc. (NASDAQ:SANA) is the least popular one with only 7 bullish hedge fund positions. PNM Resources, Inc. (NYSE:PNM) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for PNM is 72. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 31.1% in 2021 through December 9th and beat the market again by 5.1 percentage points. Unfortunately PNM wasn’t nearly as popular as these 5 stocks and hedge funds that were betting on PNM were disappointed as the stock returned -8.6% since the end of September (through 12/9) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 5 most popular stocks among hedge funds as many of these stocks already outperformed the market since 2019.

Follow Txnm Energy Inc (NYSE:TXNM)

Follow Txnm Energy Inc (NYSE:TXNM)

Receive real-time insider trading and news alerts

Suggested Articles:

- 10 Best Dividend Stocks to Buy and Hold According to Tiger Cub Lee Ainslie

- 25 Best Caribbean Islands To Visit

- 10 Best Communication Stocks to Buy Now

Disclosure: None. This article was originally published at Insider Monkey.