We at Insider Monkey have gone over 821 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of March 31st, near the height of the coronavirus market crash. In this article, we look at what those funds think of Perficient, Inc. (NASDAQ:PRFT) based on that data.

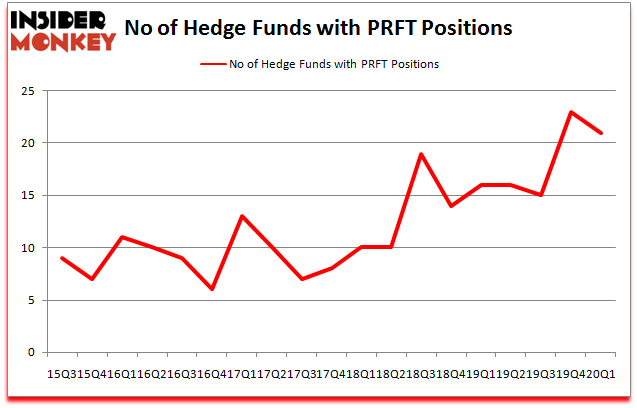

Is Perficient, Inc. (NASDAQ:PRFT) a buy, sell, or hold? Money managers are taking a bearish view. The number of long hedge fund positions dropped by 2 recently. Our calculations also showed that PRFT isn’t among the 30 most popular stocks among hedge funds (click for Q1 rankings and see the video for a quick look at the top 5 stocks). PRFT was in 21 hedge funds’ portfolios at the end of the first quarter of 2020. There were 23 hedge funds in our database with PRFT positions at the end of the previous quarter.

Video: Watch our video about the top 5 most popular hedge fund stocks.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the S&P 500 ETFs by more than 58 percentage points since March 2017 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in stocks that are in our short portfolio.

Richard Driehaus of Driehaus Capital

At Insider Monkey we leave no stone unturned when looking for the next great investment idea. For example, 2020’s unprecedented market conditions provide us with the highest number of trading opportunities in a decade. So we are checking out trades like this one. We interview hedge fund managers and ask them about their best ideas. If you want to find out the best healthcare stock to buy right now, you can watch our latest hedge fund manager interview here. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. Our best call in 2020 was shorting the market when the S&P 500 was trading at 3150 after realizing the coronavirus pandemic’s significance before most investors. Keeping this in mind we’re going to take a glance at the key hedge fund action regarding Perficient, Inc. (NASDAQ:PRFT).

Hedge fund activity in Perficient, Inc. (NASDAQ:PRFT)

At the end of the first quarter, a total of 21 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards PRFT over the last 18 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Richard Driehaus’s Driehaus Capital has the largest position in Perficient, Inc. (NASDAQ:PRFT), worth close to $16.5 million, amounting to 0.5% of its total 13F portfolio. Coming in second is GLG Partners, managed by Noam Gottesman, which holds a $9.2 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Other peers with similar optimism encompass Mark Coe’s Intrinsic Edge Capital, Ken Griffin’s Citadel Investment Group and Robert B. Gillam’s McKinley Capital Management. In terms of the portfolio weights assigned to each position Manatuck Hill Partners allocated the biggest weight to Perficient, Inc. (NASDAQ:PRFT), around 1.61% of its 13F portfolio. Intrinsic Edge Capital is also relatively very bullish on the stock, earmarking 0.85 percent of its 13F equity portfolio to PRFT.

Because Perficient, Inc. (NASDAQ:PRFT) has faced declining sentiment from the entirety of the hedge funds we track, we can see that there lies a certain “tier” of money managers that decided to sell off their entire stakes last quarter. At the top of the heap, Ken Grossman and Glen Schneider’s SG Capital Management dumped the biggest investment of all the hedgies followed by Insider Monkey, comprising about $9.2 million in stock. Minhua Zhang’s fund, Weld Capital Management, also dumped its stock, about $1.2 million worth. These moves are important to note, as total hedge fund interest fell by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Perficient, Inc. (NASDAQ:PRFT). These stocks are Sandstorm Gold Ltd. (NYSE:SAND), BGC Partners, Inc. (NASDAQ:BGCP), Beam Therapeutics Inc. (NASDAQ:BEAM), and Opko Health Inc. (NASDAQ:OPK). All of these stocks’ market caps match PRFT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SAND | 13 | 64388 | 0 |

| BGCP | 31 | 142549 | 4 |

| BEAM | 11 | 157065 | 11 |

| OPK | 13 | 9526 | -3 |

| Average | 17 | 93382 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $93 million. That figure was $59 million in PRFT’s case. BGC Partners, Inc. (NASDAQ:BGCP) is the most popular stock in this table. On the other hand Beam Therapeutics Inc. (NASDAQ:BEAM) is the least popular one with only 11 bullish hedge fund positions. Perficient, Inc. (NASDAQ:PRFT) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 10 most popular stocks among hedge funds returned 41.4% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks gained 12.2% in 2020 through June 17th but still beat the market by 14.8 percentage points. Hedge funds were also right about betting on PRFT as the stock returned 31.8% in Q2 (through June 17th) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow Perficient Inc (NASDAQ:PRFT)

Follow Perficient Inc (NASDAQ:PRFT)

Receive real-time insider trading and news alerts

Disclosure: None. This article was originally published at Insider Monkey.