Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of June. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is PACCAR Inc (NASDAQ:PCAR), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

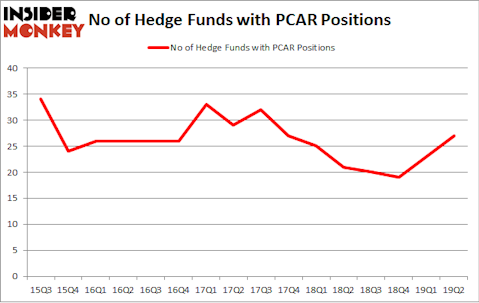

Is PACCAR Inc (NASDAQ:PCAR) worth your attention right now? Money managers are turning bullish. The number of bullish hedge fund positions increased by 4 recently. Our calculations also showed that PCAR isn’t among the 30 most popular stocks among hedge funds. PCAR was in 27 hedge funds’ portfolios at the end of June. There were 23 hedge funds in our database with PCAR positions at the end of the previous quarter.

In the financial world there are plenty of formulas stock market investors can use to value publicly traded companies. A duo of the most underrated formulas are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the top picks of the top fund managers can outperform the market by a significant amount (see the details here).

Mario Gabelli of GAMCO Investors

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to analyze the key hedge fund action regarding PACCAR Inc (NASDAQ:PCAR).

What have hedge funds been doing with PACCAR Inc (NASDAQ:PCAR)?

Heading into the third quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the first quarter of 2019. Below, you can check out the change in hedge fund sentiment towards PCAR over the last 16 quarters. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

More specifically, Two Sigma Advisors was the largest shareholder of PACCAR Inc (NASDAQ:PCAR), with a stake worth $38.1 million reported as of the end of March. Trailing Two Sigma Advisors was GAMCO Investors, which amassed a stake valued at $29.5 million. AQR Capital Management, D E Shaw, and Stevens Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, some big names have been driving this bullishness. Adage Capital Management, managed by Phill Gross and Robert Atchinson, assembled the largest position in PACCAR Inc (NASDAQ:PCAR). Adage Capital Management had $5.3 million invested in the company at the end of the quarter. Michael Kharitonov and Jon David McAuliffe’s Voleon Capital also made a $4.2 million investment in the stock during the quarter. The following funds were also among the new PCAR investors: Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, Paul Tudor Jones’s Tudor Investment Corp, and Perella Weinberg Partners.

Let’s go over hedge fund activity in other stocks similar to PACCAR Inc (NASDAQ:PCAR). We will take a look at Sun Life Financial Inc. (NYSE:SLF), FleetCor Technologies, Inc. (NYSE:FLT), Veeva Systems Inc (NYSE:VEEV), and Cerner Corporation (NASDAQ:CERN). This group of stocks’ market values are similar to PCAR’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SLF | 11 | 183793 | 0 |

| FLT | 40 | 1863052 | 6 |

| VEEV | 35 | 1355258 | 8 |

| CERN | 29 | 1211492 | 0 |

| Average | 28.75 | 1153399 | 3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 28.75 hedge funds with bullish positions and the average amount invested in these stocks was $1153 million. That figure was $154 million in PCAR’s case. FleetCor Technologies, Inc. (NYSE:FLT) is the most popular stock in this table. On the other hand Sun Life Financial Inc. (NYSE:SLF) is the least popular one with only 11 bullish hedge fund positions. PACCAR Inc (NASDAQ:PCAR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Unfortunately PCAR wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); PCAR investors were disappointed as the stock returned -1.8% during the third quarter and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as many of these stocks already outperformed the market so far in 2019.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.