Hedge funds are not perfect. They have their bad picks just like everyone else. Facebook, a stock hedge funds have loved dearly, lost nearly 40% of its value at one point in 2018. Although hedge funds are not perfect, their consensus picks do deliver solid returns, however. Our data show the top 20 S&P 500 stocks among hedge funds beat the S&P 500 Index by more than 6 percentage points so far in 2019. Because hedge funds have a lot of resources and their consensus picks do well, we pay attention to what they think. In this article, we analyze what the elite funds think of Old Line Bancshares, Inc. (NASDAQ:OLBK).

Hedge fund interest in Old Line Bancshares, Inc. (NASDAQ:OLBK) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT), Franklin Financial Network Inc (NYSE:FSB), and One Madison Corporation (NYSE:OMAD) to gather more data points.

To most market participants, hedge funds are assumed to be slow, old investment vehicles of yesteryear. While there are more than 8000 funds with their doors open at the moment, Our experts look at the aristocrats of this club, around 750 funds. Most estimates calculate that this group of people shepherd the majority of all hedge funds’ total asset base, and by keeping track of their top stock picks, Insider Monkey has revealed a number of investment strategies that have historically outrun Mr. Market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by around 5 percentage points per year since its inception in May 2014 through June 18th. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 28.2% since February 2017 (through June 18th) even though the market was up nearly 30% during the same period. We just shared a list of 5 short targets in our latest quarterly update and they are already down an average of 8.2% in a month whereas our long picks outperformed the market by 2.5 percentage points in this volatile 5 week period (our long picks also beat the market by 15 percentage points so far this year).

We’re going to take a look at the fresh hedge fund action surrounding Old Line Bancshares, Inc. (NASDAQ:OLBK).

What have hedge funds been doing with Old Line Bancshares, Inc. (NASDAQ:OLBK)?

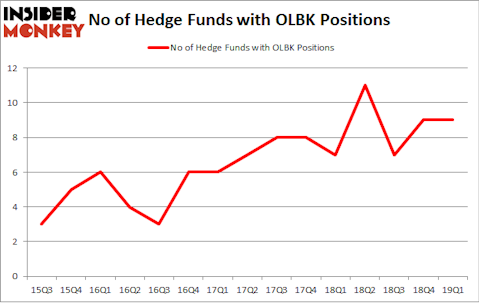

At the end of the first quarter, a total of 9 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. On the other hand, there were a total of 7 hedge funds with a bullish position in OLBK a year ago. With hedgies’ sentiment swirling, there exists an “upper tier” of key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

More specifically, Mendon Capital Advisors was the largest shareholder of Old Line Bancshares, Inc. (NASDAQ:OLBK), with a stake worth $17.1 million reported as of the end of March. Trailing Mendon Capital Advisors was Renaissance Technologies, which amassed a stake valued at $9.9 million. Royce & Associates, Basswood Capital, and Elizabeth Park Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Seeing as Old Line Bancshares, Inc. (NASDAQ:OLBK) has experienced falling interest from the entirety of the hedge funds we track, it’s safe to say that there exists a select few money managers who were dropping their positions entirely last quarter. Interestingly, Paul Magidson, Jonathan Cohen. And Ostrom Enders’s Castine Capital Management dumped the largest position of the “upper crust” of funds monitored by Insider Monkey, worth an estimated $4.6 million in stock, and Lawrence Seidman’s Seidman Investment Partnership was right behind this move, as the fund dropped about $0.6 million worth. These bearish behaviors are important to note, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks similar to Old Line Bancshares, Inc. (NASDAQ:OLBK). We will take a look at MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT), Franklin Financial Network Inc (NYSE:FSB), One Madison Corporation (NYSE:OMAD), and Foundation Building Materials, Inc. (NYSE:FBM). This group of stocks’ market values resemble OLBK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MCFT | 16 | 105346 | -4 |

| FSB | 4 | 13855 | -1 |

| OMAD | 13 | 65860 | 2 |

| FBM | 8 | 7482 | 2 |

| Average | 10.25 | 48136 | -0.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $48 million. That figure was $37 million in OLBK’s case. MasterCraft Boat Holdings, Inc. (NASDAQ:MCFT) is the most popular stock in this table. On the other hand Franklin Financial Network Inc (NYSE:FSB) is the least popular one with only 4 bullish hedge fund positions. Old Line Bancshares, Inc. (NASDAQ:OLBK) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately OLBK wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); OLBK investors were disappointed as the stock returned 2.6% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.