Legendary investors such as Leon Cooperman and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we will analyze Oasis Petroleum Inc. (NYSE:OAS) from the perspective of those elite funds.

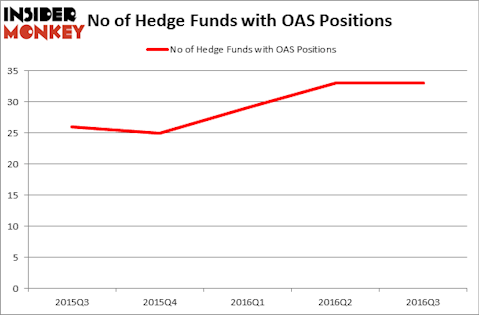

Overall, Oasis Petroleum Inc. (NYSE:OAS) shares haven’t seen a lot of action during the fourth quarter. During the third quarter, the hedge fund sentiment remained unchanged and the stock was included in the equity portfolios of 33 investors from our database at the end of September. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Main Street Capital Corporation (NYSE:MAIN), Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO), and WD-40 Company (NASDAQ:WDFC) to gather more data points.

Follow Chord Energy Corp (NASDAQ:CHRD)

Follow Chord Energy Corp (NASDAQ:CHRD)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

QiuJu Song/Shutterstock.com

With all of this in mind, let’s take a look at the latest action regarding Oasis Petroleum Inc. (NYSE:OAS).

How are hedge funds trading Oasis Petroleum Inc. (NYSE:OAS)?

As stated earlier, during the third quarter, the number of funds tracked by Insider Monkey long Oasis Petroleum remained unchanged at 33. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were increasing their holdings significantly (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, SPO Advisory Corp, managed by John H. Scully, holds the most valuable position in Oasis Petroleum Inc. (NYSE:OAS). SPO Advisory Corp has a $228.4 million position in the stock, comprising 4% of its 13F portfolio. On SPO Advisory Corp’s heels is Israel Englander’s Millennium Management holding a $70.2 million position; the fund has 0.1% of its 13F portfolio invested in the stock. Remaining professional money managers that hold long positions consist of John Paulson’s Paulson & Co, Dmitry Balyasny’s Balyasny Asset Management and John Griffin’s Blue Ridge Capital.

Seeing as Oasis Petroleum Inc. (NYSE:OAS) has faced falling interest from the entirety of the hedge funds we track, logic holds that there is a sect of money managers that elected to cut their positions entirely last quarter. It’s worth mentioning that John Labanowski’s Brenham Capital Management sold off the biggest position of all the hedgies watched by Insider Monkey, totaling about $48.6 million in stock. Anand Parekh’s fund, Alyeska Investment Group, also dumped its stock, about $21.4 million worth. These moves are intriguing to say the least, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Oasis Petroleum Inc. (NYSE:OAS) but similarly valued. These stocks are Main Street Capital Corporation (NYSE:MAIN), Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO), WD-40 Company (NASDAQ:WDFC), and IAMGOLD Corporation (USA) (NYSE:IAG). This group of stocks’ market values match OAS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAIN | 8 | 14735 | 2 |

| SIMO | 23 | 254015 | 2 |

| WDFC | 9 | 74012 | 3 |

| IAG | 17 | 154807 | 7 |

As you can see these stocks had an average of 14 investors with bullish positions and the average amount invested in these stocks was $124 million. That figure was $639 million in OAS’s case. Silicon Motion Technology Corp. (ADR) (NASDAQ:SIMO) is the most popular stock in this table. On the other hand Main Street Capital Corporation (NYSE:MAIN) is the least popular one with only eight funds reporting long positions as of the end of September. Compared to these stocks Oasis Petroleum Inc. (NYSE:OAS) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.