Hedge funds and other investment firms run by legendary investors like Israel Englander, Jeffrey Talpins and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

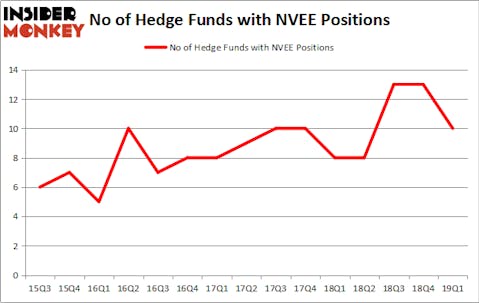

NV5 Holdings Inc (NASDAQ:NVEE) was in 10 hedge funds’ portfolios at the end of March. NVEE shareholders have witnessed a decrease in hedge fund sentiment lately. There were 13 hedge funds in our database with NVEE positions at the end of the previous quarter. Our calculations also showed that NVEE isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s view the latest hedge fund action encompassing NV5 Holdings Inc (NASDAQ:NVEE).

What have hedge funds been doing with NV5 Holdings Inc (NASDAQ:NVEE)?

At the end of the first quarter, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -23% from the fourth quarter of 2018. On the other hand, there were a total of 8 hedge funds with a bullish position in NVEE a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Manatuck Hill Partners, managed by Mark Broach, holds the number one position in NV5 Holdings Inc (NASDAQ:NVEE). Manatuck Hill Partners has a $9.7 million position in the stock, comprising 4.6% of its 13F portfolio. On Manatuck Hill Partners’s heels is Driehaus Capital, led by Richard Driehaus, holding a $5.3 million position; 0.2% of its 13F portfolio is allocated to the company. Other members of the smart money with similar optimism consist of Keith M. Rosenbloom’s Cruiser Capital Advisors, Paul Hondros’s AlphaOne Capital Partners and Brian C. Freckmann’s Lyon Street Capital.

Because NV5 Holdings Inc (NASDAQ:NVEE) has experienced falling interest from the smart money, it’s easy to see that there is a sect of hedgies who were dropping their entire stakes heading into Q3. Interestingly, Chuck Royce’s Royce & Associates sold off the largest position of the 700 funds followed by Insider Monkey, valued at an estimated $1.9 million in stock, and Jim Simons’s Renaissance Technologies was right behind this move, as the fund said goodbye to about $1.8 million worth. These transactions are interesting, as aggregate hedge fund interest fell by 3 funds heading into Q3.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as NV5 Holdings Inc (NASDAQ:NVEE) but similarly valued. These stocks are Mammoth Energy Services, Inc. (NASDAQ:TUSK), NanoString Technologies Inc (NASDAQ:NSTG), DMC Global Inc. (NASDAQ:BOOM), and Party City Holdco Inc (NYSE:PRTY). All of these stocks’ market caps are closest to NVEE’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TUSK | 17 | 389043 | 0 |

| NSTG | 22 | 143670 | 7 |

| BOOM | 14 | 86851 | 2 |

| PRTY | 19 | 69139 | 1 |

| Average | 18 | 172176 | 2.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18 hedge funds with bullish positions and the average amount invested in these stocks was $172 million. That figure was $25 million in NVEE’s case. NanoString Technologies Inc (NASDAQ:NSTG) is the most popular stock in this table. On the other hand DMC Global Inc. (NASDAQ:BOOM) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks NV5 Holdings Inc (NASDAQ:NVEE) is even less popular than BOOM. Hedge funds clearly dropped the ball on NVEE as the stock delivered strong returns, though hedge funds’ consensus picks still generated respectable returns. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. A small number of hedge funds were also right about betting on NVEE as the stock returned 31.2% during the same period and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.