Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

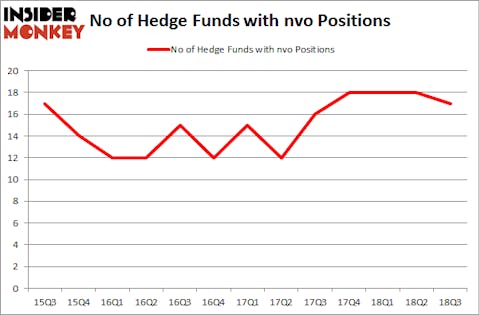

Is Novo Nordisk A/S (NYSE:NVO) a buy right now? Hedge funds are taking a bearish view. The number of long hedge fund bets were cut by 1 lately. Our calculations also showed that nvo isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to view the key hedge fund action surrounding Novo Nordisk A/S (NYSE:NVO).

How are hedge funds trading Novo Nordisk A/S (NYSE:NVO)?

At Q3’s end, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -6% from one quarter earlier. By comparison, 18 hedge funds held shares or bullish call options in NVO heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Renaissance Technologies held the most valuable stake in Novo Nordisk A/S (NYSE:NVO), which was worth $927.1 million at the end of the third quarter. On the second spot was Fisher Asset Management which amassed $650.4 million worth of shares. Moreover, Arrowstreet Capital, Markel Gayner Asset Management, and Millennium Management were also bullish on Novo Nordisk A/S (NYSE:NVO), allocating a large percentage of their portfolios to this stock.

Since Novo Nordisk A/S (NYSE:NVO) has faced a decline in interest from the smart money, it’s safe to say that there exists a select few money managers that elected to cut their entire stakes last quarter. At the top of the heap, Hal Mintz’s Sabby Capital dropped the largest position of the 700 funds followed by Insider Monkey, worth an estimated $19.8 million in call options. Hal Mintz’s fund, Sabby Capital, also dumped its call options, about $18.3 million worth. These moves are important to note, as aggregate hedge fund interest fell by 1 funds last quarter.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Novo Nordisk A/S (NYSE:NVO) but similarly valued. These stocks are United Technologies Corporation (NYSE:UTX), Sanofi (NYSE:SNY), The Toronto-Dominion Bank (NYSE:TD), and Accenture Plc (NYSE:ACN). This group of stocks’ market values are closest to NVO’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| UTX | 59 | 7281525 | 7 |

| SNY | 24 | 821542 | 1 |

| TD | 20 | 1423010 | 3 |

| ACN | 34 | 1002113 | 11 |

| Average | 34.25 | 2632048 | 5.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 34.25 hedge funds with bullish positions and the average amount invested in these stocks was $2.63 billion. That figure was $1.85 billion in NVO’s case. United Technologies Corporation (NYSE:UTX) is the most popular stock in this table. On the other hand The Toronto-Dominion Bank (NYSE:TD) is the least popular one with only 20 bullish hedge fund positions. Compared to these stocks Novo Nordisk A/S (NYSE:NVO) is even less popular than TD. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.