Hedge funds are known to underperform the bull markets but that’s not because they are terrible at stock picking. Hedge funds underperform because their net exposure in only 40-70% and they charge exorbitant fees. No one knows what the future holds and how market participants will react to the bountiful news that floods in each day. However, hedge funds’ consensus picks on average deliver market beating returns. For example in the first 5 months of this year through May 30th the Standard and Poor’s 500 Index returned approximately 12.1% (including dividend payments). Conversely, hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the same 5-month period, with the majority of these stock picks outperforming the broader market benchmark. Interestingly, an average long/short hedge fund returned only a fraction of this value due to the hedges they implemented and the large fees they charged. If you pay attention to the actual hedge fund returns versus the returns of their long stock picks, you might believe that it is a waste of time to analyze hedge funds’ purchases. We know better. That’s why we scrutinize hedge fund sentiment before we invest in a stock like NetGear, Inc. (NASDAQ:NTGR).

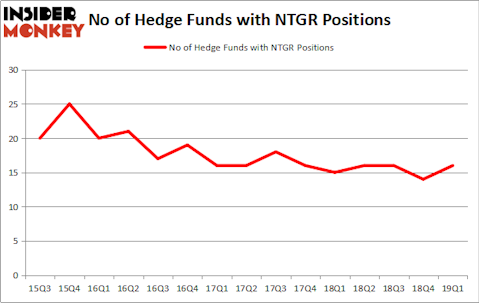

NetGear, Inc. (NASDAQ:NTGR) was in 16 hedge funds’ portfolios at the end of the first quarter of 2019. NTGR investors should be aware of an increase in hedge fund interest in recent months. There were 14 hedge funds in our database with NTGR positions at the end of the previous quarter. Our calculations also showed that NTGR isn’t among the 30 most popular stocks among hedge funds.

In today’s marketplace there are numerous gauges stock market investors put to use to size up stocks. Some of the most under-the-radar gauges are hedge fund and insider trading activity. We have shown that, historically, those who follow the top picks of the top hedge fund managers can outclass the broader indices by a significant amount (see the details here).

Let’s take a look at the recent hedge fund action surrounding NetGear, Inc. (NASDAQ:NTGR).

Hedge fund activity in NetGear, Inc. (NASDAQ:NTGR)

At Q1’s end, a total of 16 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 14% from the previous quarter. The graph below displays the number of hedge funds with bullish position in NTGR over the last 15 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in NetGear, Inc. (NASDAQ:NTGR) was held by Royce & Associates, which reported holding $5.9 million worth of stock at the end of March. It was followed by AWH Capital with a $4 million position. Other investors bullish on the company included Renaissance Technologies, Citadel Investment Group, and AQR Capital Management.

As one would reasonably expect, some big names were breaking ground themselves. AWH Capital, managed by Austin Wiggins Hopper, created the largest position in NetGear, Inc. (NASDAQ:NTGR). AWH Capital had $4 million invested in the company at the end of the quarter. Joel Greenblatt’s Gotham Asset Management also initiated a $1.6 million position during the quarter. The other funds with new positions in the stock are Ken Griffin’s Citadel Investment Group, Matthew Hulsizer’s PEAK6 Capital Management, and Matthew Hulsizer’s PEAK6 Capital Management.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as NetGear, Inc. (NASDAQ:NTGR) but similarly valued. These stocks are Homology Medicines, Inc. (NASDAQ:FIXX), New York Mortgage Trust, Inc. (NASDAQ:NYMT), Evolent Health Inc (NYSE:EVH), and Sonos, Inc. (NASDAQ:SONO). This group of stocks’ market caps are similar to NTGR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FIXX | 7 | 200196 | -1 |

| NYMT | 6 | 15030 | -3 |

| EVH | 19 | 80950 | 5 |

| SONO | 22 | 75062 | 10 |

| Average | 13.5 | 92810 | 2.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 13.5 hedge funds with bullish positions and the average amount invested in these stocks was $93 million. That figure was $22 million in NTGR’s case. Sonos, Inc. (NASDAQ:SONO) is the most popular stock in this table. On the other hand New York Mortgage Trust, Inc. (NASDAQ:NYMT) is the least popular one with only 6 bullish hedge fund positions. NetGear, Inc. (NASDAQ:NTGR) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately NTGR wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on NTGR were disappointed as the stock returned -18.8% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.