Does National-Oilwell Varco, Inc. (NYSE:NOV) represent a good buying opportunity at the moment? Let’s briefly check the hedge fund sentiment towards the company. Hedge fund firms constantly search out bright intellectuals and highly-experienced employees and throw away millions of dollars on research activities, so it is no wonder why they tend to generate millions in profits each year. It is also true that some hedge fund players fail unconceivably on some occasions, but their stock picks have been generating superior risk-adjusted returns on average over the years.

National-Oilwell Varco, Inc. (NYSE:NOV) has experienced an increase in support from the world’s most elite money managers of late. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Macerich Co (NYSE:MAC), Nomura Holdings, Inc. (ADR) (NYSE:NMR), and Whirlpool Corporation (NYSE:WHR) to gather more data points.

Follow Nov Inc. (NYSE:NOV)

Follow Nov Inc. (NYSE:NOV)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

PLRANG ART/Shutterstock.com

Now, we’re going to take a gander at the key action surrounding National-Oilwell Varco, Inc. (NYSE:NOV).

What does the smart money think about National-Oilwell Varco, Inc. (NYSE:NOV)?

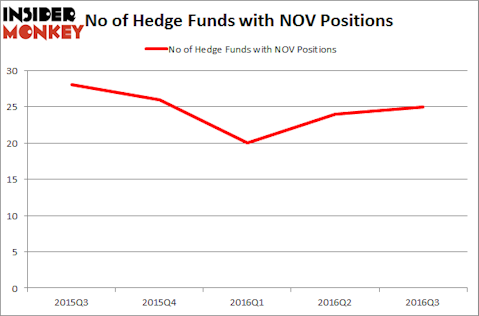

At the end of the third quarter, a total of 25 of the hedge funds tracked by Insider Monkey held long positions in this stock, up 4% from one quarter earlier. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Select Equity Group, managed by Robert Joseph Caruso, holds the most valuable position in National-Oilwell Varco, Inc. (NYSE:NOV). According to regulatory filings, the fund has a $75.4 million position in the stock, comprising 0.7% of its 13F portfolio. Coming in second is Ariel Investments, managed by John W. Rogers, which holds a $62.9 million position; the fund has 0.8% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism contain Till Bechtolsheimer’s Arosa Capital Management, Jim Simons’s Renaissance Technologies and Ken Griffin’s Citadel Investment Group.

As industrywide interest jumped, some big names have been driving this bullishness. Arosa Capital Management, managed by Till Bechtolsheimer, established the biggest position in National-Oilwell Varco, Inc. (NYSE:NOV). The fund reportedly had $55.4 million invested in the company at the end of the quarter. Ken Griffin’s Citadel Investment Group also initiated a $12.9 million call options position during the quarter. The other funds with new positions in the stock are Israel Englander’s Millennium Management, Robert Vollero and Gentry T. Beach’s Vollero Beach Capital Partners, and T Boone Pickens’s BP Capital.

Let’s go over hedge fund activity in other stocks similar to National-Oilwell Varco, Inc. (NYSE:NOV). These stocks are Macerich Co (NYSE:MAC), Nomura Holdings, Inc. (ADR) (NYSE:NMR), Whirlpool Corporation (NYSE:WHR), and Waste Connections, Inc. (NYSE:WCN). This group of stocks’ market caps are similar to NOV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAC | 19 | 272669 | -1 |

| NMR | 3 | 5817 | -3 |

| WHR | 34 | 1469379 | -3 |

| WCN | 29 | 986577 | 1 |

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $684 million. That figure was $329 million in NOV’s case. Whirlpool Corporation (NYSE:WHR) is the most popular stock in this table. On the other hand Nomura Holdings, Inc. (ADR) (NYSE:NMR) is the least popular one with only 3 bullish hedge fund positions. National-Oilwell Varco, Inc. (NYSE:NOV) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard WHR might be a better candidate to consider a long position.

Disclosure: none.