Billionaire hedge fund managers such as David Abrams, Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the nearly unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

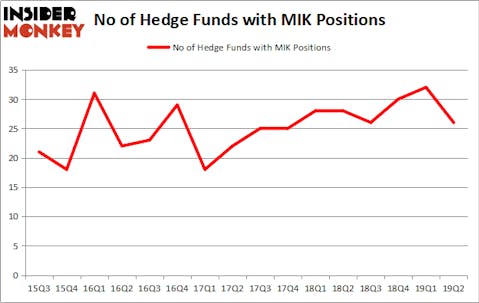

Michaels Companies Inc (NASDAQ:MIK) has seen a decrease in activity from the world’s largest hedge funds recently. MIK was in 26 hedge funds’ portfolios at the end of the second quarter of 2019. There were 32 hedge funds in our database with MIK positions at the end of the previous quarter. Our calculations also showed that MIK isn’t among the 30 most popular stocks among hedge funds (see the video below).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to take a look at the key hedge fund action surrounding Michaels Companies Inc (NASDAQ:MIK).

What does smart money think about Michaels Companies Inc (NASDAQ:MIK)?

At the end of the second quarter, a total of 26 of the hedge funds tracked by Insider Monkey were long this stock, a change of -19% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in MIK over the last 16 quarters. So, let’s check out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, AQR Capital Management held the most valuable stake in Michaels Companies Inc (NASDAQ:MIK), which was worth $14.5 million at the end of the second quarter. On the second spot was Balyasny Asset Management which amassed $11.9 million worth of shares. Moreover, Gotham Asset Management, Samlyn Capital, and Skylands Capital were also bullish on Michaels Companies Inc (NASDAQ:MIK), allocating a large percentage of their portfolios to this stock.

Due to the fact that Michaels Companies Inc (NASDAQ:MIK) has witnessed bearish sentiment from the entirety of the hedge funds we track, logic holds that there is a sect of money managers that slashed their full holdings by the end of the second quarter. Interestingly, Jonathon Jacobson’s Highfields Capital Management said goodbye to the biggest position of the “upper crust” of funds followed by Insider Monkey, worth close to $37.6 million in stock, and Israel Englander’s Millennium Management was right behind this move, as the fund dropped about $13.5 million worth. These bearish behaviors are intriguing to say the least, as total hedge fund interest was cut by 6 funds by the end of the second quarter.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Michaels Companies Inc (NASDAQ:MIK) but similarly valued. We will take a look at Varex Imaging Corporation (NASDAQ:VREX), Momenta Pharmaceuticals, Inc. (NASDAQ:MNTA), Atkore International Group Inc. (NYSE:ATKR), and Harmony Gold Mining Co. (NYSE:HMY). All of these stocks’ market caps are closest to MIK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VREX | 20 | 98089 | 0 |

| MNTA | 19 | 181200 | 1 |

| ATKR | 17 | 90536 | -2 |

| HMY | 10 | 40696 | 1 |

| Average | 16.5 | 102630 | 0 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 16.5 hedge funds with bullish positions and the average amount invested in these stocks was $103 million. That figure was $57 million in MIK’s case. Varex Imaging Corporation (NASDAQ:VREX) is the most popular stock in this table. On the other hand Harmony Gold Mining Co. (NYSE:HMY) is the least popular one with only 10 bullish hedge fund positions. Compared to these stocks Michaels Companies Inc (NASDAQ:MIK) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. Hedge funds were also right about betting on MIK as the stock returned 12.5% during Q3 and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Disclosure: None. This article was originally published at Insider Monkey.