The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Lincoln Electric Holdings, Inc. (NASDAQ:LECO).

Hedge fund interest in Lincoln Electric Holdings, Inc. (NASDAQ:LECO) shares was flat at the end of last quarter. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as YPF Sociedad Anonima (NYSE:YPF), Integrated Device Technology, Inc. (NASDAQ:IDTI), and JetBlue Airways Corporation (NASDAQ:JBLU) to gather more data points.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

Let’s take a look at the latest hedge fund action surrounding Lincoln Electric Holdings, Inc. (NASDAQ:LECO).

How are hedge funds trading Lincoln Electric Holdings, Inc. (NASDAQ:LECO)?

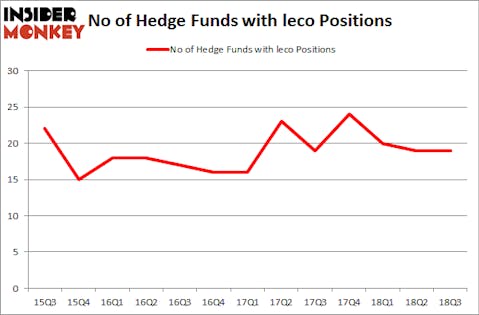

At Q3’s end, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from the previous quarter. Below, you can check out the change in hedge fund sentiment towards LECO over the last 13 quarters. With hedge funds’ sentiment swirling, there exists a select group of notable hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Royce & Associates, managed by Chuck Royce, holds the biggest position in Lincoln Electric Holdings, Inc. (NASDAQ:LECO). Royce & Associates has a $112.1 million position in the stock, comprising 0.8% of its 13F portfolio. On Royce & Associates’s heels is Fisher Asset Management, led by Ken Fisher, holding a $98.9 million position; 0.1% of its 13F portfolio is allocated to the company. Remaining professional money managers that are bullish contain Ken Griffin’s Citadel Investment Group, Paul Marshall and Ian Wace’s Marshall Wace LLP and John Overdeck and David Siegel’s Two Sigma Advisors.

Seeing as Lincoln Electric Holdings, Inc. (NASDAQ:LECO) has experienced declining sentiment from the smart money, it’s easy to see that there was a specific group of money managers who sold off their full holdings heading into Q3. Interestingly, Phill Gross and Robert Atchinson’s Adage Capital Management dropped the largest investment of the “upper crust” of funds tracked by Insider Monkey, valued at close to $21.8 million in stock, and Peter Muller’s PDT Partners was right behind this move, as the fund said goodbye to about $11.3 million worth. These moves are interesting, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Lincoln Electric Holdings, Inc. (NASDAQ:LECO) but similarly valued. We will take a look at YPF Sociedad Anonima (NYSE:YPF), Integrated Device Technology, Inc. (NASDAQ:IDTI), JetBlue Airways Corporation (NASDAQ:JBLU), and New Residential Investment Corp (NYSE:NRZ). All of these stocks’ market caps resemble LECO’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| YPF | 17 | 241797 | -7 |

| IDTI | 35 | 838486 | 19 |

| JBLU | 30 | 560163 | 3 |

| NRZ | 16 | 115070 | -3 |

| Average | 24.5 | 438879 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $439 million. That figure was $366 million in LECO’s case. Integrated Device Technology, Inc. (NASDAQ:IDTI) is the most popular stock in this table. On the other hand New Residential Investment Corp (NYSE:NRZ) is the least popular one with only 16 bullish hedge fund positions. Lincoln Electric Holdings, Inc. (NASDAQ:LECO) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard IDTI might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.