Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth depends on it. Regardless of the various methods used by elite investors like David Tepper and Dan Loeb, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space. In this article, we are going to analyze Liberty Latin America Ltd. (NASDAQ:LILAK), and try to determine if the stock is a good investment opportunity at the moment.

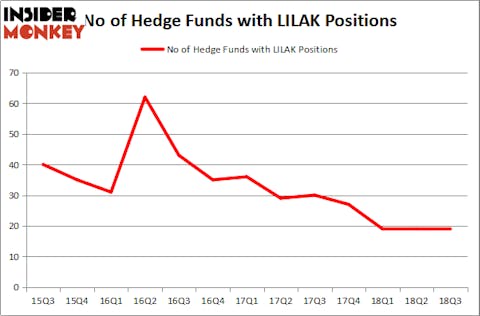

Liberty Latin America Ltd. (NASDAQ:LILAK) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 19 hedge funds’ portfolios on September 30, which wasn’t enough to place it among 30 most popular stocks among hedge funds in Q3 of 2018. At the end of this article we will also compare LILAK to other stocks including Uniti Group Inc. (NASDAQ:UNIT), SM Energy Co. (NYSE:SM), Anglogold Ashanti Ltd (NYSE:AU), and Cracker Barrel Old Country Store Inc (NASDAQ:CBRL) to get a better sense of its popularity.

Today there are plenty of indicators market participants have at their disposal to assess publicly traded companies. A couple of the less known indicators are hedge fund and insider trading interest. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outclass their index-focused peers by a solid margin (see the details here).

While researching further about Liberty Latin America Ltd. (NASDAQ:LILAK), we stumbled upon this Saga Partners’ Quarterly Report, in which the fund shares its opinion on the stock. We bring you a few paragraphs from the report:

“As of 2Q results, Puerto Rico’s network is nearly 100% restored since Hurricane Maria hit in Fall 2017. LILAK recently announced they are acquiring the remaining 40% of the Puerto Rico operating segment they did not already own by issuing 9.5 million shares for the purchase value of $185 million at the time of the transaction.

LILAK is a dominant operator in the region and in a strong position to consolidate the fragmented region with many of its competitors burdened with heavier debt loads.

Overall growth has been pretty lackluster in recent years, but we expect LILAK to be able to grow operating income in the mid to high single digit range organically with the potential for further acquisitions, however most operating cash flow will be plowed back into the company to build out the infrastructure. The Company’s most recent results reflect slower growth rates but the question is if this reflects temporary headwinds due to hurricane impacts and management reorganization. Regardless, we think the lower valuation multiple limits the downside of slower growth and provides strong upside if LILAK can start building some momentum.”

Now it’s time to review the latest hedge fund action surrounding the company.

What have hedge funds been doing with Liberty Latin America Ltd. (NASDAQ:LILAK)?

Heading into the fourth quarter of 2018, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, same as in the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in LILAK over the last 13 quarters. With hedge funds’ capital changing hands, there exists an “upper tier” of key hedge fund managers who were upping their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ashe Capital, managed by William Crowley, William Harker, and Stephen Blass, holds the biggest position in Liberty Latin America Ltd. (NASDAQ:LILAK). Ashe Capital has a $91.7 million position in the stock, comprising 6.2% of its 13F portfolio. On Ashe Capital’s heels is Fine Capital Partners, led by Debra Fine, holding a $82.1 million position; the fund has 10.4% of its 13F portfolio invested in the stock. Some other members of the smart money with similar optimism encompass Ryan Pedlow’s Two Creeks Capital Management, Boykin Curry’s Eagle Capital Management and Wallace Weitz’s Wallace R. Weitz & Co..

It’s worth mentioning that Michael Hintze’s CQS Cayman LP said goodbye to the largest stake of all the hedgies monitored by Insider Monkey, comprising about $2 million in stock, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital was right behind this move, as the fund cut about $10,000 worth. These transactions are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Liberty Latin America Ltd. (NASDAQ:LILAK) but similarly valued. We will take a look at SM Energy Co. (NYSE:SM), Uniti Group Inc. (NASDAQ:UNIT), AngloGold Ashanti Limited (NYSE:AU), and Cracker Barrel Old Country Store, Inc. (NASDAQ:CBRL). This group of stocks’ market caps resemble LILAK’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SM | 25 | 580195 | 3 |

| UNIT | 14 | 268082 | -4 |

| AU | 10 | 193265 | -2 |

| CBRL | 12 | 170523 | -2 |

As you can see these stocks had an average of 15 hedge funds with bullish positions and the average amount invested in these stocks was $303 million. That figure was $394 million in LILAK’s case. SM Energy Co. (NYSE:SM) is the most popular stock in this table. On the other hand Anglogold Ashanti Ltd (NYSE:AU) is the least popular one with only 10 bullish hedge fund positions. Liberty Latin America Ltd. (NASDAQ:LILAK) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SM might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.