Is Liberty Global plc (NASDAQ:LBTYA) a good investment right now? We check hedge fund and billionaire investor sentiment before delving into hours of research. Hedge funds spend millions of dollars on Ivy League graduates, expert networks, and get tips from industry insiders. They sometimes fail miserably but historically their consensus stock picks outperformed the market after adjusting for known risk factors.

Is Liberty Global plc (NASDAQ:LBTYA) the right investment to pursue these days? Money managers are becoming hopeful. The number of bullish hedge fund bets rose by 5 lately. Our calculations also showed that LBTYA isn’t among the 30 most popular stocks among hedge funds. LBTYA was in 39 hedge funds’ portfolios at the end of the third quarter of 2018. There were 34 hedge funds in our database with LBTYA positions at the end of the previous quarter.

Today there are a lot of methods stock market investors put to use to value stocks. A duo of the most underrated methods are hedge fund and insider trading sentiment. Our researchers have shown that, historically, those who follow the best picks of the top fund managers can outclass their index-focused peers by a healthy margin (see the details here).

Warren Buffett of Berkshire Hathaway

Let’s take a peek at the latest hedge fund action regarding Liberty Global plc (NASDAQ:LBTYA).

Hedge fund activity in Liberty Global plc (NASDAQ:LBTYA)

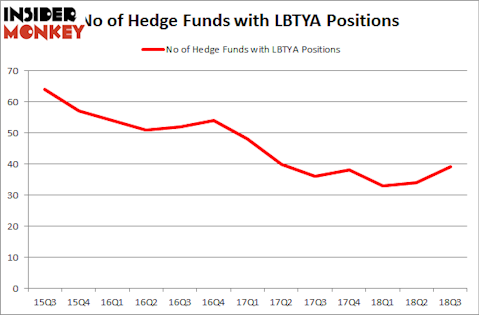

At the end of the third quarter, a total of 39 of the hedge funds tracked by Insider Monkey were long this stock, a change of 15% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in LBTYA over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

More specifically, Berkshire Hathaway was the largest shareholder of Liberty Global plc (NASDAQ:LBTYA), with a stake worth $572.6 million reported as of the end of September. Trailing Berkshire Hathaway was Route One Investment Company, which amassed a stake valued at $246.3 million. Farallon Capital, Glenview Capital, and Baupost Group were also very fond of the stock, giving the stock large weights in their portfolios.

Now, key money managers have jumped into Liberty Global plc (NASDAQ:LBTYA) headfirst. Baupost Group, managed by Seth Klarman, created the biggest position in Liberty Global plc (NASDAQ:LBTYA). Baupost Group had $143.4 million invested in the company at the end of the quarter. John Ku’s Manor Road Capital Partners also initiated a $13 million position during the quarter. The following funds were also among the new LBTYA investors: Jim Simons’s Renaissance Technologies, Ray Dalio’s Bridgewater Associates, and Mike Vranos’s Ellington.

Let’s now take a look at hedge fund activity in other stocks similar to Liberty Global plc (NASDAQ:LBTYA). These stocks are NetApp Inc. (NASDAQ:NTAP), Aptiv PLC (NYSE:APTV), Coca-Cola European Partners plc (NYSE:CCE), and Edison International (NYSE:EIX). This group of stocks’ market caps match LBTYA’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NTAP | 27 | 886361 | 0 |

| APTV | 43 | 1626371 | 0 |

| CCE | 23 | 476588 | 1 |

| EIX | 25 | 1198233 | -3 |

| Average | 29.5 | 1046888 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.5 hedge funds with bullish positions and the average amount invested in these stocks was $1.05 billion. That figure was $1.70 billion in LBTYA’s case. Aptiv PLC (NYSE:APTV) is the most popular stock in this table. On the other hand Coca-Cola European Partners plc (NYSE:CCE) is the least popular one with only 23 bullish hedge fund positions. Liberty Global plc (NASDAQ:LBTYA) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard APTV might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.