There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Jeff Ubben, George Soros and Carl Icahn think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other elite funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze Kirby Corporation (NYSE:KEX).

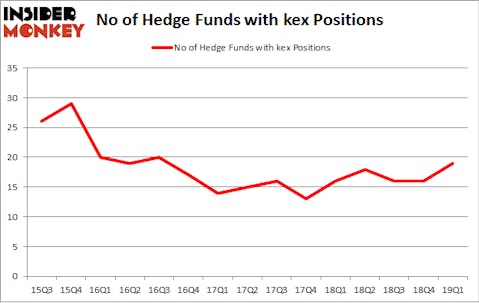

Is Kirby Corporation (NYSE:KEX) a buy here? Hedge funds are getting more optimistic. The number of long hedge fund positions improved by 3 lately. Our calculations also showed that kex isn’t among the 30 most popular stocks among hedge funds. KEX was in 19 hedge funds’ portfolios at the end of March. There were 16 hedge funds in our database with KEX positions at the end of the previous quarter.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

We’re going to take a look at the latest hedge fund action encompassing Kirby Corporation (NYSE:KEX).

What have hedge funds been doing with Kirby Corporation (NYSE:KEX)?

Heading into the second quarter of 2019, a total of 19 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 19% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards KEX over the last 15 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the biggest position in Kirby Corporation (NYSE:KEX), worth close to $189.4 million, comprising 1% of its total 13F portfolio. The second most bullish fund manager is Chuck Royce of Royce & Associates, with a $101.9 million position; 0.9% of its 13F portfolio is allocated to the company. Remaining professional money managers with similar optimism contain David Greenspan’s Slate Path Capital, Alexander Mitchell’s Scopus Asset Management and Brian Ashford-Russell and Tim Woolley’s Polar Capital.

As industrywide interest jumped, key hedge funds were leading the bulls’ herd. Slate Path Capital, managed by David Greenspan, initiated the most outsized position in Kirby Corporation (NYSE:KEX). Slate Path Capital had $62 million invested in the company at the end of the quarter. Alexander Mitchell’s Scopus Asset Management also made a $48.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Zachary Miller’s Parian Global Management, Clint Murray’s Lodge Hill Capital, and Ken Grossman and Glen Schneider’s SG Capital Management.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Kirby Corporation (NYSE:KEX) but similarly valued. These stocks are Flowers Foods, Inc. (NYSE:FLO), Mattel, Inc. (NASDAQ:MAT), Viper Energy Partners LP (NASDAQ:VNOM), and United Microelectronics Corp (NYSE:UMC). All of these stocks’ market caps are closest to KEX’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FLO | 18 | 190309 | -2 |

| MAT | 21 | 703901 | 6 |

| VNOM | 17 | 190764 | 7 |

| UMC | 15 | 86705 | -2 |

| Average | 17.75 | 292920 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $293 million. That figure was $514 million in KEX’s case. Mattel, Inc. (NASDAQ:MAT) is the most popular stock in this table. On the other hand United Microelectronics Corp (NYSE:UMC) is the least popular one with only 15 bullish hedge fund positions. Kirby Corporation (NYSE:KEX) is not the most popular stock in this group but hedge fund interest is still above average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Hedge funds were also right about betting on KEX as the stock returned 4.9% during the same period and outperformed the market by an even larger margin. Hedge funds were rewarded for their relative bullishness.

Disclosure: None. This article was originally published at Insider Monkey.