Amid an overall bull market, many stocks that smart money investors were collectively bullish on surged during the first quarter. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 40% and 25% respectively. Our research shows that most of the stocks that smart money likes historically generate strong risk-adjusted returns. That’s why we weren’t surprised when hedge funds’ top 20 large-cap stock picks generated a return of 18.7% during the first 5 months of 2019 and outperformed the broader market benchmark by 6.6 percentage points.This is why following the smart money sentiment is a useful tool at identifying the next stock to invest in.

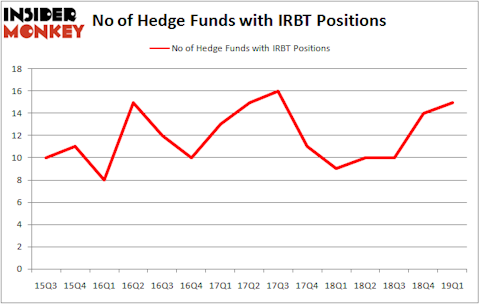

Is iRobot Corporation (NASDAQ:IRBT) going to take off soon? Investors who are in the know are becoming more confident. The number of bullish hedge fund positions improved by 1 recently. Our calculations also showed that IRBT isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Let’s take a look at the fresh hedge fund action surrounding iRobot Corporation (NASDAQ:IRBT).

Hedge fund activity in iRobot Corporation (NASDAQ:IRBT)

Heading into the second quarter of 2019, a total of 15 of the hedge funds tracked by Insider Monkey were long this stock, a change of 7% from the previous quarter. On the other hand, there were a total of 9 hedge funds with a bullish position in IRBT a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Principal Global Investors’s Columbus Circle Investors has the biggest position in iRobot Corporation (NASDAQ:IRBT), worth close to $35.3 million, comprising 0.9% of its total 13F portfolio. The second most bullish fund manager is D E Shaw, led by D. E. Shaw, holding a $26.6 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Other members of the smart money that hold long positions contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, and Dmitry Balyasny’s Balyasny Asset Management.

As industrywide interest jumped, key hedge funds have jumped into iRobot Corporation (NASDAQ:IRBT) headfirst. Citadel Investment Group, managed by Ken Griffin, established the most outsized position in iRobot Corporation (NASDAQ:IRBT). Citadel Investment Group had $5.5 million invested in the company at the end of the quarter. Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital also initiated a $4.6 million position during the quarter. The other funds with new positions in the stock are Noam Gottesman’s GLG Partners, Jeffrey Talpins’s Element Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as iRobot Corporation (NASDAQ:IRBT) but similarly valued. These stocks are Bank of Hawaii Corporation (NYSE:BOH), Lions Gate Entertainment Corporation (NYSE:LGF-A), American National Insurance Company (NASDAQ:ANAT), and NCR Corporation (NYSE:NCR). This group of stocks’ market values are closest to IRBT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BOH | 12 | 126229 | -1 |

| LGF-A | 18 | 315578 | -3 |

| ANAT | 9 | 37272 | -6 |

| NCR | 22 | 250591 | 2 |

| Average | 15.25 | 182418 | -2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.25 hedge funds with bullish positions and the average amount invested in these stocks was $182 million. That figure was $122 million in IRBT’s case. NCR Corporation (NYSE:NCR) is the most popular stock in this table. On the other hand American National Insurance Company (NASDAQ:ANAT) is the least popular one with only 9 bullish hedge fund positions. iRobot Corporation (NASDAQ:IRBT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately IRBT wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); IRBT investors were disappointed as the stock returned -21% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.