The elite funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Insulet Corporation (NASDAQ:PODD) from the perspective of those elite funds.

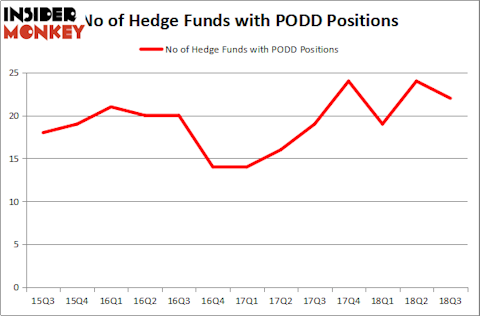

Is Insulet Corporation (NASDAQ:PODD) a buy, sell, or hold? The best stock pickers are taking a bearish view. The number of long hedge fund bets decreased by 2 in recent months. Our calculations also showed that PODD isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to take a look at the recent hedge fund action encompassing Insulet Corporation (NASDAQ:PODD).

What does the smart money think about Insulet Corporation (NASDAQ:PODD)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were long this stock, a change of -8% from the second quarter of 2018. The graph below displays the number of hedge funds with bullish position in PODD over the last 13 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, D E Shaw held the most valuable stake in Insulet Corporation (NASDAQ:PODD), which was worth $151 million at the end of the third quarter. On the second spot was Think Investments which amassed $56.6 million worth of shares. Moreover, Columbus Circle Investors, Citadel Investment Group, and Renaissance Technologies were also bullish on Insulet Corporation (NASDAQ:PODD), allocating a large percentage of their portfolios to this stock.

Because Insulet Corporation (NASDAQ:PODD) has faced bearish sentiment from the aggregate hedge fund industry, we can see that there exists a select few money managers who were dropping their entire stakes by the end of the third quarter. Intriguingly, Brian Ashford-Russell and Tim Woolley’s Polar Capital dumped the largest investment of the 700 funds monitored by Insider Monkey, comprising an estimated $17.1 million in stock. Peter Rathjens, Bruce Clarke and John Campbell’s fund, Arrowstreet Capital, also dropped its stock, about $7.7 million worth. These bearish behaviors are intriguing to say the least, as aggregate hedge fund interest was cut by 2 funds by the end of the third quarter.

Let’s also examine hedge fund activity in other stocks similar to Insulet Corporation (NASDAQ:PODD). We will take a look at Liberty Property Trust (NYSE:LPT), Methanex Corporation (NASDAQ:MEOH), BWX Technologies Inc (NYSE:BWXT), and WABCO Holdings Inc. (NYSE:WBC). All of these stocks’ market caps are similar to PODD’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LPT | 18 | 400987 | -3 |

| MEOH | 21 | 301336 | 3 |

| BWXT | 17 | 205166 | -6 |

| WBC | 15 | 590018 | -8 |

| Average | 17.75 | 374377 | -3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17.75 hedge funds with bullish positions and the average amount invested in these stocks was $374 million. That figure was $472 million in PODD’s case. Methanex Corporation (NASDAQ:MEOH) is the most popular stock in this table. On the other hand WABCO Holdings Inc. (NYSE:WBC) is the least popular one with only 15 bullish hedge fund positions. Compared to these stocks Insulet Corporation (NASDAQ:PODD) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.