The market has been volatile as the Federal Reserve continues its rate hikes to normalize the interest rates. Small cap stocks have been hit hard as a result, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by about 4 percentage points through November 16th. SEC filings and hedge fund investor letters indicate that the smart money seems to be paring back their overall long exposure since summer months, and the funds’ movements is one of the reasons why the major indexes have retraced. In this article, we analyze what the smart money thinks of Insight Enterprises, Inc. (NASDAQ:NSIT) and find out how it is affected by hedge funds’ moves.

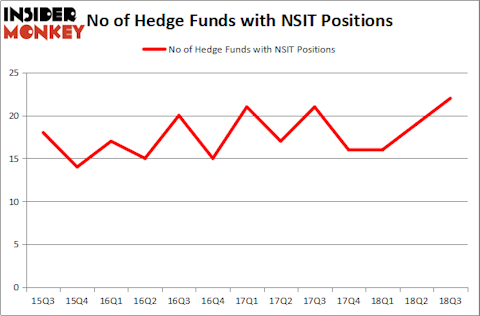

Insight Enterprises, Inc. (NASDAQ:NSIT) was in 22 hedge funds’ portfolios at the end of September. NSIT has seen an increase in hedge fund interest of late. There were 19 hedge funds in our database with NSIT positions at the end of the previous quarter. Our calculations also showed that NSIT isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s analyze the fresh hedge fund action surrounding Insight Enterprises, Inc. (NASDAQ:NSIT).

How are hedge funds trading Insight Enterprises, Inc. (NASDAQ:NSIT)?

At Q3’s end, a total of 22 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 16% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in NSIT over the last 13 quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

More specifically, Pzena Investment Management was the largest shareholder of Insight Enterprises, Inc. (NASDAQ:NSIT), with a stake worth $47 million reported as of the end of September. Trailing Pzena Investment Management was Royce & Associates, which amassed a stake valued at $26.7 million. AQR Capital Management, GLG Partners, and Hawk Ridge Management were also very fond of the stock, giving the stock large weights in their portfolios.

With a general bullishness amongst the heavyweights, specific money managers were leading the bulls’ herd. GLG Partners, managed by Noam Gottesman, created the biggest position in Insight Enterprises, Inc. (NASDAQ:NSIT). GLG Partners had $11.9 million invested in the company at the end of the quarter. Brandon Haley’s Holocene Advisors also made a $0.5 million investment in the stock during the quarter. The other funds with new positions in the stock are David Costen Haley’s HBK Investments, Jeffrey Talpins’s Element Capital Management, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Insight Enterprises, Inc. (NASDAQ:NSIT) but similarly valued. These stocks are Laredo Petroleum Inc (NYSE:LPI), Mack Cali Realty Corp (NYSE:CLI), MSG Networks Inc (NYSE:MSGN), and Shenandoah Telecommunications Company (NASDAQ:SHEN). This group of stocks’ market values match NSIT’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| LPI | 20 | 589934 | 4 |

| CLI | 11 | 113715 | -3 |

| MSGN | 23 | 383172 | 0 |

| SHEN | 14 | 72514 | 8 |

| Average | 17 | 289834 | 2.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $290 million. That figure was $140 million in NSIT’s case. MSG Networks Inc (NYSE:MSGN) is the most popular stock in this table. On the other hand Mack Cali Realty Corp (NYSE:CLI) is the least popular one with only 11 bullish hedge fund positions. Insight Enterprises, Inc. (NASDAQ:NSIT) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MSGN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.