Hedge Funds and other institutional investors have just completed filing their 13Fs with the Securities and Exchange Commission, revealing their equity portfolios as of the end of December. At Insider Monkey, we follow nearly 750 active hedge funds and notable investors and by analyzing their 13F filings, we can determine the stocks that they are collectively bullish on. One of their picks is ICICI Bank Limited (NYSE:IBN), so let’s take a closer look at the sentiment that surrounds it in the current quarter.

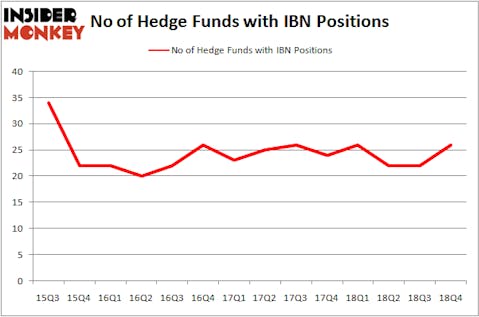

Is ICICI Bank Limited (NYSE:IBN) a buy right now? Prominent investors are getting more optimistic. The number of bullish hedge fund bets improved by 4 in recent months. Our calculations also showed that IBN isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter.

Let’s check out the latest hedge fund action encompassing ICICI Bank Limited (NYSE:IBN).

What have hedge funds been doing with ICICI Bank Limited (NYSE:IBN)?

At the end of the fourth quarter, a total of 26 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 18% from the previous quarter. On the other hand, there were a total of 26 hedge funds with a bullish position in IBN a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were upping their stakes substantially (or already accumulated large positions).

Among these funds, Oaktree Capital Management held the most valuable stake in ICICI Bank Limited (NYSE:IBN), which was worth $96.8 million at the end of the third quarter. On the second spot was LMR Partners which amassed $70.9 million worth of shares. Moreover, Discovery Capital Management, Driehaus Capital, and D E Shaw were also bullish on ICICI Bank Limited (NYSE:IBN), allocating a large percentage of their portfolios to this stock.

As aggregate interest increased, key hedge funds have been driving this bullishness. LMR Partners, managed by Ben Levine, Andrew Manuel and Stefan Renold, established the biggest position in ICICI Bank Limited (NYSE:IBN). LMR Partners had $70.9 million invested in the company at the end of the quarter. Josh Donfeld and David Rogers’s Castle Hook Partners also made a $42.9 million investment in the stock during the quarter. The following funds were also among the new IBN investors: Jonathan Soros’s JS Capital, Jasjit Rekhi’s Sanoor Capital, and Glenn Russell Dubin’s Highbridge Capital Management.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as ICICI Bank Limited (NYSE:IBN) but similarly valued. These stocks are Canadian Imperial Bank of Commerce (NYSE:CM), Ecopetrol S.A. (NYSE:EC), China Unicom (Hong Kong) Limited (NYSE:CHU), and National Grid plc (NYSE:NGG). This group of stocks’ market caps are similar to IBN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CM | 15 | 358649 | 1 |

| EC | 16 | 192561 | 3 |

| CHU | 9 | 60531 | 3 |

| NGG | 10 | 310855 | -1 |

| Average | 12.5 | 230649 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $231 million. That figure was $746 million in IBN’s case. Ecopetrol S.A. (NYSE:EC) is the most popular stock in this table. On the other hand China Unicom (Hong Kong) Limited (NYSE:CHU) is the least popular one with only 9 bullish hedge fund positions. Compared to these stocks ICICI Bank Limited (NYSE:IBN) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Unfortunately IBN wasn’t in this group. Hedge funds that bet on IBN were disappointed as the stock returned 9.9% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 13 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.