While the market driven by short-term sentiment influenced by the accomodative interest rate environment in the US, increasing oil prices and optimism towards the resolution of the trade war with China, many smart money investors kept their cautious approach regarding the current bull run in the first quarter and hedging or reducing many of their long positions. However, as we know, big investors usually buy stocks with strong fundamentals, which is why we believe we can profit from imitating them. In this article, we are going to take a look at the smart money sentiment surrounding Fortune Brands Home & Security Inc (NYSE:FBHS).

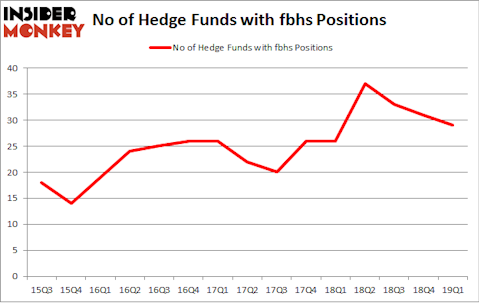

Fortune Brands Home & Security Inc (NYSE:FBHS) was in 29 hedge funds’ portfolios at the end of March. FBHS investors should be aware of a decrease in activity from the world’s largest hedge funds of late. There were 31 hedge funds in our database with FBHS positions at the end of the previous quarter. Our calculations also showed that fbhs isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a multitude of gauges stock traders put to use to size up publicly traded companies. A couple of the most innovative gauges are hedge fund and insider trading indicators. Our experts have shown that, historically, those who follow the top picks of the best money managers can beat the S&P 500 by a significant amount (see the details here).

We’re going to take a peek at the recent hedge fund action surrounding Fortune Brands Home & Security Inc (NYSE:FBHS).

How are hedge funds trading Fortune Brands Home & Security Inc (NYSE:FBHS)?

At the end of the first quarter, a total of 29 of the hedge funds tracked by Insider Monkey were long this stock, a change of -6% from the previous quarter. By comparison, 26 hedge funds held shares or bullish call options in FBHS a year ago. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Citadel Investment Group held the most valuable stake in Fortune Brands Home & Security Inc (NYSE:FBHS), which was worth $117.4 million at the end of the first quarter. On the second spot was Adage Capital Management which amassed $80.5 million worth of shares. Moreover, GAMCO Investors, Two Sigma Advisors, and Millennium Management were also bullish on Fortune Brands Home & Security Inc (NYSE:FBHS), allocating a large percentage of their portfolios to this stock.

Seeing as Fortune Brands Home & Security Inc (NYSE:FBHS) has witnessed bearish sentiment from the smart money, it’s easy to see that there is a sect of funds who were dropping their full holdings last quarter. Interestingly, Jim Simons’s Renaissance Technologies cut the biggest investment of all the hedgies tracked by Insider Monkey, comprising an estimated $23 million in stock, and Sander Gerber’s Hudson Bay Capital Management was right behind this move, as the fund dumped about $3.3 million worth. These transactions are important to note, as total hedge fund interest fell by 2 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks similar to Fortune Brands Home & Security Inc (NYSE:FBHS). These stocks are AptarGroup, Inc. (NYSE:ATR), Amarin Corporation plc (NASDAQ:AMRN), Moderna, Inc. (NASDAQ:MRNA), and Zayo Group Holdings Inc (NYSE:ZAYO). This group of stocks’ market valuations match FBHS’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ATR | 15 | 81382 | -2 |

| AMRN | 26 | 1959411 | 2 |

| MRNA | 15 | 492608 | -2 |

| ZAYO | 61 | 1681079 | 5 |

| Average | 29.25 | 1053620 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 29.25 hedge funds with bullish positions and the average amount invested in these stocks was $1054 million. That figure was $569 million in FBHS’s case. Zayo Group Holdings Inc (NYSE:ZAYO) is the most popular stock in this table. On the other hand AptarGroup, Inc. (NYSE:ATR) is the least popular one with only 15 bullish hedge fund positions. Fortune Brands Home & Security Inc (NYSE:FBHS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. A small number of hedge funds were also right about betting on FBHS as the stock returned 6.5% during the same time frame and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.