The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards Fortuna Silver Mines Inc. (NYSE:FSM).

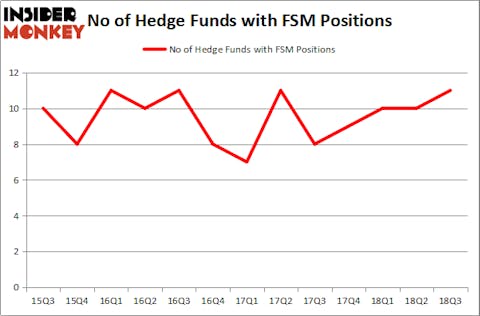

Fortuna Silver Mines Inc. (NYSE:FSM) has experienced an increase in enthusiasm from smart money of late. Our calculations also showed that FSM isn’t among the 30 most popular stocks among hedge funds.

To most stock holders, hedge funds are viewed as unimportant, outdated investment tools of yesteryear. While there are greater than 8,000 funds trading at present, Our experts choose to focus on the top tier of this club, about 700 funds. It is estimated that this group of investors orchestrate the majority of the smart money’s total asset base, and by keeping track of their highest performing stock picks, Insider Monkey has determined various investment strategies that have historically outpaced the broader indices. Insider Monkey’s flagship hedge fund strategy surpassed the S&P 500 index by 6 percentage points per year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 24% since February 2017 (through December 3rd) even though the market was up nearly 23% during the same period. We just shared a list of 11 short targets in our latest quarterly update.

Let’s take a peek at the recent hedge fund action encompassing Fortuna Silver Mines Inc. (NYSE:FSM).

What does the smart money think about Fortuna Silver Mines Inc. (NYSE:FSM)?

At Q3’s end, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a change of 10% from one quarter earlier. On the other hand, there were a total of 9 hedge funds with a bullish position in FSM at the beginning of this year. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Fortuna Silver Mines Inc. (NYSE:FSM) was held by Renaissance Technologies, which reported holding $16.7 million worth of stock at the end of September. It was followed by Sprott Asset Management with a $6.1 million position. Other investors bullish on the company included Millennium Management, D E Shaw, and Two Sigma Advisors.

As one would reasonably expect, key hedge funds were leading the bulls’ herd. Signition LP, managed by George Zweig, Shane Haas and Ravi Chander, created the most valuable position in Fortuna Silver Mines Inc. (NYSE:FSM). Signition LP had $0.1 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also initiated a $0.1 million position during the quarter. The other funds with new positions in the stock are David Costen Haley’s HBK Investments and Frederick DiSanto’s Ancora Advisors.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Fortuna Silver Mines Inc. (NYSE:FSM) but similarly valued. These stocks are Civeo Corporation (NYSE:CVEO), DXP Enterprises Inc (NASDAQ:DXPE), Upland Software Inc (NASDAQ:UPLD), and Changyou.Com Ltd (NASDAQ:CYOU). This group of stocks’ market valuations are closest to FSM’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVEO | 12 | 260239 | 0 |

| DXPE | 12 | 55449 | 2 |

| UPLD | 20 | 102948 | -1 |

| CYOU | 6 | 32636 | -3 |

| Average | 12.5 | 112818 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.5 hedge funds with bullish positions and the average amount invested in these stocks was $113 million. That figure was $32 million in FSM’s case. Upland Software Inc (NASDAQ:UPLD) is the most popular stock in this table. On the other hand Changyou.Com Ltd (NASDAQ:CYOU) is the least popular one with only 6 bullish hedge fund positions. Fortuna Silver Mines Inc. (NYSE:FSM) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard UPLD might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.