Will the new coronavirus cause a recession in US in the next 6 months? We put he probability at 75%. We estimate that COVID-19 will kill around 5 million people worldwide and there is a 3.3% probability that Donald Trump will die from the new coronavirus (read the details). In these volatile markets we scrutinize hedge fund filings to get a reading on which direction each stock might be going. In this article, we will take a closer look at hedge fund sentiment towards Fiserv, Inc. (NASDAQ:FISV).

Fiserv, Inc. (NASDAQ:FISV) has seen a decrease in support from the world’s most elite money managers in recent months. Our calculations also showed that FISV isn’t among the 30 most popular stocks among hedge funds (click for Q4 rankings and see the video below for Q3 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

If you’d ask most investors, hedge funds are assumed to be worthless, outdated investment tools of yesteryear. While there are more than 8000 funds in operation at the moment, Our experts choose to focus on the masters of this group, around 850 funds. These investment experts orchestrate the lion’s share of all hedge funds’ total asset base, and by paying attention to their best picks, Insider Monkey has deciphered many investment strategies that have historically beaten Mr. Market. Insider Monkey’s flagship short hedge fund strategy beat the S&P 500 short ETFs by around 20 percentage points a year since its inception in March 2017. Our portfolio of short stocks lost 35.3% since February 2017 (through March 3rd) even though the market was up more than 35% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

John Armitage of Egerton Capital

We leave no stone unturned when looking for the next great investment idea. For example Europe is set to become the world’s largest cannabis market, so we check out this European marijuana stock pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences, and and go through short-term trade recommendations like this one. We even check out the recommendations of services with hard to believe track records. In January, we recommended a long position in one of the most shorted stocks in the market, and that stock returned more than 50% despite the large losses in the market since our recommendation. Now we’re going to take a gander at the new hedge fund action regarding Fiserv, Inc. (NASDAQ:FISV).

How have hedgies been trading Fiserv, Inc. (NASDAQ:FISV)?

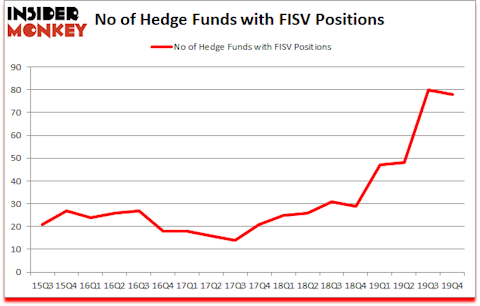

At the end of the foruth quarter, a total of 78 of the hedge funds tracked by Insider Monkey were long this stock, a change of -3% from the third quarter of 2019. The graph below displays the number of hedge funds with bullish position in FISV over the last 18 quarters. With hedgies’ capital changing hands, there exists a select group of key hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

Among these funds, Egerton Capital Limited held the most valuable stake in Fiserv, Inc. (NASDAQ:FISV), which was worth $892 million at the end of the third quarter. On the second spot was Eagle Capital Management which amassed $409.4 million worth of shares. Kensico Capital, Point State Capital, and Omega Advisors were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Toscafund Asset Management allocated the biggest weight to Fiserv, Inc. (NASDAQ:FISV), around 28.98% of its 13F portfolio. Caldera Capital is also relatively very bullish on the stock, designating 17.29 percent of its 13F equity portfolio to FISV.

Seeing as Fiserv, Inc. (NASDAQ:FISV) has witnessed a decline in interest from hedge fund managers, logic holds that there was a specific group of hedge funds who were dropping their full holdings in the third quarter. Intriguingly, James Parsons’s Junto Capital Management cut the largest investment of all the hedgies followed by Insider Monkey, worth about $67.8 million in stock. Lee Ainslie’s fund, Maverick Capital, also dumped its stock, about $63 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest was cut by 2 funds in the third quarter.

Let’s go over hedge fund activity in other stocks similar to Fiserv, Inc. (NASDAQ:FISV). We will take a look at Stryker Corporation (NYSE:SYK), BlackRock, Inc. (NYSE:BLK), Anthem Inc (NYSE:ANTM), and Cigna Corporation (NYSE:CI). This group of stocks’ market caps are closest to FISV’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SYK | 43 | 833267 | 7 |

| BLK | 43 | 916922 | -4 |

| ANTM | 71 | 4833772 | 7 |

| CI | 72 | 4118635 | 7 |

| Average | 57.25 | 2675649 | 4.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 57.25 hedge funds with bullish positions and the average amount invested in these stocks was $2676 million. That figure was $4174 million in FISV’s case. Cigna Corporation (NYSE:CI) is the most popular stock in this table. On the other hand Stryker Corporation (NYSE:SYK) is the least popular one with only 43 bullish hedge fund positions. Compared to these stocks Fiserv, Inc. (NASDAQ:FISV) is more popular among hedge funds. Our calculations showed that top 20 most popular stocks among hedge funds returned 41.3% in 2019 and outperformed the S&P 500 ETF (SPY) by 10.1 percentage points. These stocks also gained 0.1% in 2020 through March 2nd and beat the market by 4.1 percentage points. Hedge funds were also right about betting on FISV, though not to the same extent, as the stock returned -1.2% during the first quarter (through March 2nd) and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.