Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by nearly 9 percentage points since the end of the third quarter of 2018 as investors worried over the possible ramifications of rising interest rates and escalation of the trade war with China. The hedge funds and institutional investors we track typically invest more in smaller-cap stocks than an average investor (i.e. only 298 S&P 500 constituents were among the 500 most popular stocks among hedge funds), and we have seen data that shows those funds paring back their overall exposure. Those funds cutting positions in small-caps is one reason why volatility has increased. In the following paragraphs, we take a closer look at what hedge funds and prominent investors think of First Merchants Corporation (NASDAQ:FRME) and see how the stock is affected by the recent hedge fund activity.

Hedge fund interest in First Merchants Corporation (NASDAQ:FRME) shares was flat at the end of last quarter. This is usually a negative indicator. At the end of this article we will also compare FRME to other stocks including Plantronics, Inc. (NYSE:PLT), LTC Properties Inc (NYSE:LTC), and LegacyTexas Financial Group Inc (NASDAQ:LTXB) to get a better sense of its popularity.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 40 percentage points since May 2014 through May 30, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 30.9% through May 30, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

We’re going to analyze the latest hedge fund action encompassing First Merchants Corporation (NASDAQ:FRME).

How have hedgies been trading First Merchants Corporation (NASDAQ:FRME)?

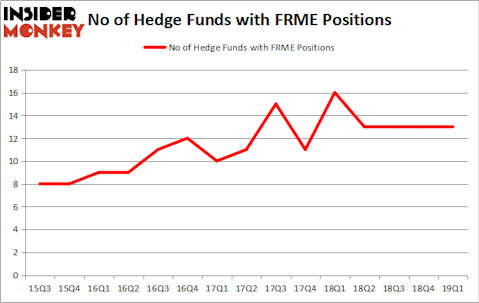

At the end of the first quarter, a total of 13 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the fourth quarter of 2018. By comparison, 16 hedge funds held shares or bullish call options in FRME a year ago. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Among these funds, Cardinal Capital held the most valuable stake in First Merchants Corporation (NASDAQ:FRME), which was worth $76.7 million at the end of the first quarter. On the second spot was Renaissance Technologies which amassed $28.6 million worth of shares. Moreover, Millennium Management, Castine Capital Management, and AQR Capital Management were also bullish on First Merchants Corporation (NASDAQ:FRME), allocating a large percentage of their portfolios to this stock.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: HBK Investments. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Minerva Advisors).

Let’s now review hedge fund activity in other stocks similar to First Merchants Corporation (NASDAQ:FRME). These stocks are Plantronics, Inc. (NYSE:PLT), LTC Properties Inc (NYSE:LTC), LegacyTexas Financial Group Inc (NASDAQ:LTXB), and Columbia Financial, Inc. (NASDAQ:CLBK). All of these stocks’ market caps are similar to FRME’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PLT | 19 | 91583 | 3 |

| LTC | 9 | 32304 | -3 |

| LTXB | 12 | 89912 | 0 |

| CLBK | 8 | 25859 | 2 |

| Average | 12 | 59915 | 0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $60 million. That figure was $147 million in FRME’s case. Plantronics, Inc. (NYSE:PLT) is the most popular stock in this table. On the other hand Columbia Financial, Inc. (NASDAQ:CLBK) is the least popular one with only 8 bullish hedge fund positions. First Merchants Corporation (NASDAQ:FRME) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 6.2% in Q2 through June 19th and outperformed the S&P 500 ETF (SPY) by nearly 3 percentage points. Unfortunately FRME wasn’t nearly as popular as these 20 stocks and hedge funds that were betting on FRME were disappointed as the stock returned -1.2% during the same period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.