Insider Monkey has processed numerous 13F filings of hedge funds and successful value investors to create an extensive database of hedge fund holdings. The 13F filings show the hedge funds’ and successful investors’ positions as of the end of the second quarter. You can find articles about an individual hedge fund’s trades on numerous financial news websites. However, in this article we will take a look at their collective moves over the last 6 years and analyze what the smart money thinks of First Industrial Realty Trust, Inc. (NYSE:FR) based on that data.

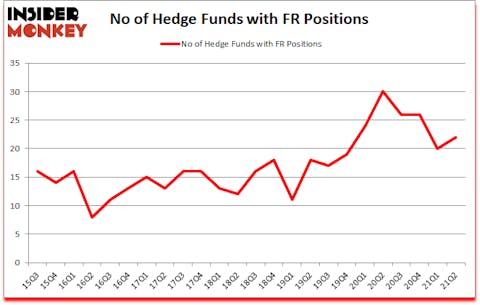

First Industrial Realty Trust, Inc. (NYSE:FR) investors should pay attention to an increase in enthusiasm from smart money recently. First Industrial Realty Trust, Inc. (NYSE:FR) was in 22 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 30. There were 20 hedge funds in our database with FR holdings at the end of March. Our calculations also showed that FR isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

If you’d ask most investors, hedge funds are seen as worthless, old financial tools of yesteryear. While there are over 8000 funds in operation at the moment, Our experts look at the crème de la crème of this club, around 850 funds. Most estimates calculate that this group of people direct the majority of the smart money’s total capital, and by tracking their highest performing stock picks, Insider Monkey has spotted various investment strategies that have historically beaten the broader indices. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per year since its inception in March 2017. Also, our monthly newsletter’s portfolio of long stock picks returned 185.4% since March 2017 (through August 2021) and beat the S&P 500 Index by more than 79 percentage points. You can download a sample issue of this newsletter on our website.

Ken Heebner of Capital Growth Management

At Insider Monkey, we scour multiple sources to uncover the next great investment idea. For example, lithium mining is one of the fastest growing industries right now, so we are checking out stock pitches like this emerging lithium stock. We go through lists like the 10 best EV stocks to pick the next Tesla that will deliver a 10x return. Even though we recommend positions in only a tiny fraction of the companies we analyze, we check out as many stocks as we can. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. You can subscribe to our free daily newsletter on our homepage. With all of this in mind we’re going to take a peek at the fresh hedge fund action surrounding First Industrial Realty Trust, Inc. (NYSE:FR).

Do Hedge Funds Think FR Is A Good Stock To Buy Now?

At second quarter’s end, a total of 22 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 10% from the first quarter of 2020. The graph below displays the number of hedge funds with bullish position in FR over the last 24 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Jonathan Litt’s Land & Buildings Investment Management has the most valuable position in First Industrial Realty Trust, Inc. (NYSE:FR), worth close to $62.3 million, accounting for 11.7% of its total 13F portfolio. On Land & Buildings Investment Management’s heels is Long Pond Capital, managed by John Khoury, which holds a $53.7 million position; the fund has 1.9% of its 13F portfolio invested in the stock. Some other peers with similar optimism encompass Eduardo Abush’s Waterfront Capital Partners, Israel Englander’s Millennium Management and John Overdeck and David Siegel’s Two Sigma Advisors. In terms of the portfolio weights assigned to each position Land & Buildings Investment Management allocated the biggest weight to First Industrial Realty Trust, Inc. (NYSE:FR), around 11.68% of its 13F portfolio. Waterfront Capital Partners is also relatively very bullish on the stock, designating 3.75 percent of its 13F equity portfolio to FR.

As industrywide interest jumped, specific money managers were breaking ground themselves. Schonfeld Strategic Advisors, managed by Ryan Tolkin (CIO), initiated the most outsized position in First Industrial Realty Trust, Inc. (NYSE:FR). Schonfeld Strategic Advisors had $6.1 million invested in the company at the end of the quarter. Daniel Johnson’s Gillson Capital also made a $6.1 million investment in the stock during the quarter. The other funds with brand new FR positions are Ken Heebner’s Capital Growth Management, Allon Hellmann’s Full18 Capital, and Michael Gelband’s ExodusPoint Capital.

Let’s check out hedge fund activity in other stocks similar to First Industrial Realty Trust, Inc. (NYSE:FR). These stocks are InVitae Corporation (NYSE:NVTA), OGE Energy Corp. (NYSE:OGE), Sonoco Products Company (NYSE:SON), Emcor Group Inc (NYSE:EME), Lemonade, Inc. (NYSE:LMND), Pinnacle Financial Partners (NASDAQ:PNFP), and Healthequity Inc (NASDAQ:HQY). All of these stocks’ market caps are closest to FR’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NVTA | 31 | 2151154 | -3 |

| OGE | 17 | 276770 | -6 |

| SON | 15 | 139239 | -10 |

| EME | 21 | 147705 | 1 |

| LMND | 15 | 182362 | -1 |

| PNFP | 13 | 69655 | -1 |

| HQY | 20 | 286344 | 2 |

| Average | 18.9 | 464747 | -2.6 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.9 hedge funds with bullish positions and the average amount invested in these stocks was $465 million. That figure was $282 million in FR’s case. InVitae Corporation (NYSE:NVTA) is the most popular stock in this table. On the other hand Pinnacle Financial Partners (NASDAQ:PNFP) is the least popular one with only 13 bullish hedge fund positions. First Industrial Realty Trust, Inc. (NYSE:FR) is not the most popular stock in this group but hedge fund interest is still above average. Our overall hedge fund sentiment score for FR is 54. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks gained 24% in 2021 through October 22nd and still beat the market by 1.6 percentage points. Hedge funds were also right about betting on FR as the stock returned 12.2% since the end of Q2 (through 10/22) and outperformed the market. Hedge funds were rewarded for their relative bullishness.

Follow First Industrial Realty Trust Inc (NYSE:FR)

Follow First Industrial Realty Trust Inc (NYSE:FR)

Receive real-time insider trading and news alerts

Suggested Articles:

- 15 Best Small-Cap Healthcare Stocks to Buy

- 15 Biggest Public Companies in the world

- 15 Fastest Growing Industries In the World

Disclosure: None. This article was originally published at Insider Monkey.