The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the second quarter, which unveil their equity positions as of September 30. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Dril-Quip, Inc. (NYSE:DRQ).

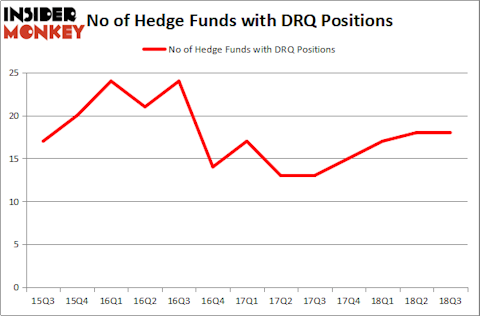

Dril-Quip, Inc. (NYSE:DRQ) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 18 hedge funds’ portfolios at the end of the third quarter of 2018. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Maxar Technologies Ltd. (NYSE:MAXR), Mobile Mini Inc (NASDAQ:MINI), and Prestige Brands Holdings, Inc. (NYSE:PBH) to gather more data points.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s view the fresh hedge fund action encompassing Dril-Quip, Inc. (NYSE:DRQ).

How have hedgies been trading Dril-Quip, Inc. (NYSE:DRQ)?

Heading into the fourth quarter of 2018, a total of 18 of the hedge funds tracked by Insider Monkey were bullish on this stock, representing no change from one quarter earlier. On the other hand, there were a total of 15 hedge funds with a bullish position in DRQ at the beginning of this year. With hedgies’ positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were increasing their holdings substantially (or already accumulated large positions).

Among these funds, Fisher Asset Management held the most valuable stake in Dril-Quip, Inc. (NYSE:DRQ), which was worth $88 million at the end of the third quarter. On the second spot was GAMCO Investors which amassed $30.1 million worth of shares. Moreover, Balyasny Asset Management, Birch Run Capital, and Two Sigma Advisors were also bullish on Dril-Quip, Inc. (NYSE:DRQ), allocating a large percentage of their portfolios to this stock.

Because Dril-Quip, Inc. (NYSE:DRQ) has faced falling interest from the entirety of the hedge funds we track, logic holds that there exists a select few hedge funds who sold off their full holdings heading into Q3. At the top of the heap, Joseph A. Jolson’s Harvest Capital Strategies said goodbye to the largest position of the “upper crust” of funds tracked by Insider Monkey, worth about $5.1 million in stock, and Steve Cohen’s Point72 Asset Management was right behind this move, as the fund dropped about $2 million worth. These bearish behaviors are interesting, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Dril-Quip, Inc. (NYSE:DRQ). We will take a look at Maxar Technologies Ltd. (NYSE:MAXR), Mobile Mini Inc (NASDAQ:MINI), Prestige Consumer Healthcare Inc. (NYSE:PBH), and Saia Inc (NASDAQ:SAIA). This group of stocks’ market valuations are similar to DRQ’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MAXR | 7 | 30129 | -1 |

| MINI | 13 | 54616 | 2 |

| PBH | 14 | 99230 | 2 |

| SAIA | 15 | 72013 | 3 |

| Average | 12.25 | 63997 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.25 hedge funds with bullish positions and the average amount invested in these stocks was $64 million. That figure was $176 million in DRQ’s case. Saia Inc (NASDAQ:SAIA) is the most popular stock in this table. On the other hand Maxar Technologies Ltd. (NYSE:MAXR) is the least popular one with only 7 bullish hedge fund positions. Compared to these stocks Dril-Quip, Inc. (NYSE:DRQ) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None. This article was originally published at Insider Monkey.