The government requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings disclosed the funds’ positions on September 30. We at Insider Monkey have made an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Digital Realty Trust, Inc. (NYSE:DLR) based on those filings.

Is Digital Realty Trust, Inc. (NYSE:DLR) an outstanding stock to buy now? The best stock pickers are buying. The number of bullish hedge fund bets increased by 14 lately. Our calculations also showed that dlr isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Cliff Asness of AQR Capital Management

Let’s view the latest hedge fund action encompassing Digital Realty Trust, Inc. (NYSE:DLR).

What does the smart money think about Digital Realty Trust, Inc. (NYSE:DLR)?

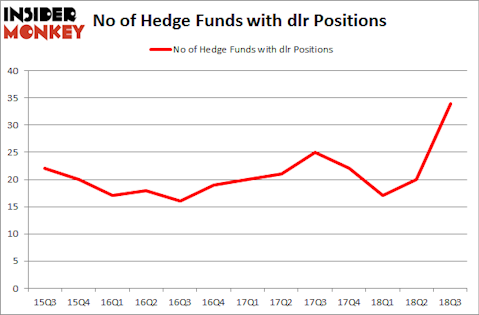

Heading into the fourth quarter of 2018, a total of 34 of the hedge funds tracked by Insider Monkey were long this stock, a change of 70% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards DLR over the last 13 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ken Griffin’s Citadel Investment Group has the most valuable position in Digital Realty Trust, Inc. (NYSE:DLR), worth close to $163.3 million, amounting to 0.1% of its total 13F portfolio. On Citadel Investment Group’s heels is Jeffrey Furber of AEW Capital Management, with a $143.7 million position; the fund has 4% of its 13F portfolio invested in the stock. Some other professional money managers with similar optimism encompass Phill Gross and Robert Atchinson’s Adage Capital Management, Cliff Asness’s AQR Capital Management and Jim Simons’s Renaissance Technologies.

As industrywide interest jumped, some big names have jumped into Digital Realty Trust, Inc. (NYSE:DLR) headfirst. Alyeska Investment Group, managed by Anand Parekh, assembled the most outsized position in Digital Realty Trust, Inc. (NYSE:DLR). Alyeska Investment Group had $16.9 million invested in the company at the end of the quarter. Nick Niell’s Arrowgrass Capital Partners also made a $11.2 million investment in the stock during the quarter. The other funds with brand new DLR positions are Greg Poole’s Echo Street Capital Management, Shane Finemore’s Manikay Partners, and Jonathan Auerbach’s Hound Partners.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Digital Realty Trust, Inc. (NYSE:DLR) but similarly valued. These stocks are Rockwell Automation Inc. (NYSE:ROK), Rockwell Collins, Inc. (NYSE:COL), Synchrony Financial (NYSE:SYF), and Interactive Brokers Group, Inc. (NASDAQ:IBKR). This group of stocks’ market valuations resemble DLR’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ROK | 28 | 633854 | -2 |

| COL | 48 | 4141035 | 9 |

| SYF | 35 | 2206905 | 5 |

| IBKR | 29 | 990268 | -4 |

| Average | 35 | 1993016 | 2 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 35 hedge funds with bullish positions and the average amount invested in these stocks was $1.993 billion. That figure was $536 million in DLR’s case. Rockwell Collins, Inc. (NYSE:COL) is the most popular stock in this table. On the other hand Rockwell Automation Inc. (NYSE:ROK) is the least popular one with only 28 bullish hedge fund positions. Digital Realty Trust, Inc. (NYSE:DLR) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard COL might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.