We are still in an overall bull market and many stocks that smart money investors were piling into surged through the end of November. Among them, Facebook and Microsoft ranked among the top 3 picks and these stocks gained 54% and 51% respectively. Hedge funds’ top 3 stock picks returned 41.7% this year and beat the S&P 500 ETFs by 14 percentage points. Investing in index funds guarantees you average returns, not superior returns. We are looking to generate superior returns for our readers. That’s why we believe it isn’t a waste of time to check out hedge fund sentiment before you invest in a stock like DCP Midstream LP (NYSE:DCP).

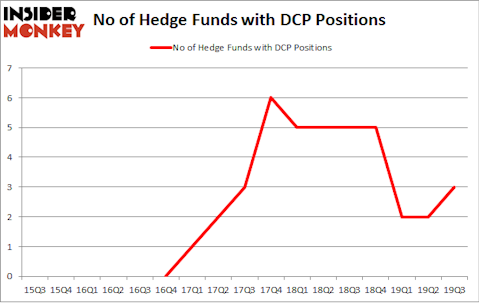

DCP Midstream LP (NYSE:DCP) has experienced an increase in hedge fund interest in recent months. Our calculations also showed that DCP isn’t among the 30 most popular stocks among hedge funds (click for Q3 rankings and see the video below for Q2 rankings).

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

To most traders, hedge funds are seen as underperforming, old financial vehicles of years past. While there are greater than 8000 funds with their doors open today, We choose to focus on the upper echelon of this club, around 750 funds. These investment experts oversee the lion’s share of the hedge fund industry’s total capital, and by keeping an eye on their unrivaled investments, Insider Monkey has unearthed numerous investment strategies that have historically outrun the market. Insider Monkey’s flagship short hedge fund strategy surpassed the S&P 500 short ETFs by around 20 percentage points per year since its inception in May 2014. Our portfolio of short stocks lost 27.8% since February 2017 (through November 21st) even though the market was up more than 39% during the same period. We just shared a list of 7 short targets in our latest quarterly update .

Richard Chilton of Chilton Investment Company

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Keeping this in mind we’re going to view the fresh hedge fund action regarding DCP Midstream LP (NYSE:DCP).

Hedge fund activity in DCP Midstream LP (NYSE:DCP)

At Q3’s end, a total of 3 of the hedge funds tracked by Insider Monkey were long this stock, a change of 50% from the previous quarter. On the other hand, there were a total of 5 hedge funds with a bullish position in DCP a year ago. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of key hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

The largest stake in DCP Midstream LP (NYSE:DCP) was held by Arrowstreet Capital, which reported holding $4.2 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $4 million position. The only other hedge fund that is bullish on the company was PEAK6 Capital Management.

As aggregate interest increased, key hedge funds were leading the bulls’ herd. Arrowstreet Capital, managed by Peter Rathjens, Bruce Clarke and John Campbell, assembled the most valuable position in DCP Midstream LP (NYSE:DCP). Arrowstreet Capital had $4.2 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $0.8 million investment in the stock during the quarter. The only other fund with a brand new DCP position is Richard Chilton’s Chilton Investment Company.

Let’s also examine hedge fund activity in other stocks similar to DCP Midstream LP (NYSE:DCP). These stocks are Cameco Corporation (NYSE:CCJ), SLM Corporation (NASDAQ:SLM), Antero Midstream Corporation (NYSE:AM), and F.N.B. Corporation (NYSE:FNB). This group of stocks’ market caps match DCP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CCJ | 25 | 384721 | 1 |

| SLM | 25 | 501007 | -7 |

| AM | 16 | 138560 | 1 |

| FNB | 18 | 107990 | -1 |

| Average | 21 | 283070 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 21 hedge funds with bullish positions and the average amount invested in these stocks was $283 million. That figure was $8 million in DCP’s case. Cameco Corporation (NYSE:CCJ) is the most popular stock in this table. On the other hand Antero Midstream Corporation (NYSE:AM) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks DCP Midstream LP (NYSE:DCP) is even less popular than AM. Hedge funds dodged a bullet by taking a bearish stance towards DCP. Our calculations showed that the top 20 most popular hedge fund stocks returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. Unfortunately DCP wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was very bearish); DCP investors were disappointed as the stock returned -16.7% during the fourth quarter (through the end of November) and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 70 percent of these stocks already outperformed the market so far in Q4.

Disclosure: None. This article was originally published at Insider Monkey.