Most investors tend to think that hedge funds and other asset managers are worthless, as they cannot beat even simple index fund portfolios. In fact, most people expect hedge funds to compete with and outperform the bull market that we have witnessed in recent years. However, hedge funds are generally partially hedged and aim at delivering attractive risk-adjusted returns rather than following the ups and downs of equity markets hoping that they will outperform the broader market. Our research shows that certain hedge funds do have great stock picking skills (and we can identify these hedge funds in advance pretty accurately), so let’s take a glance at the smart money sentiment towards Companhia Energética de Minas Gerais (NYSE:CIG).

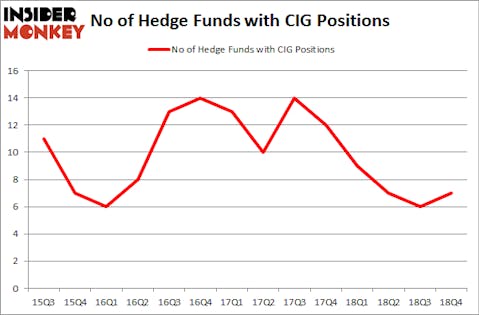

Companhia Energética de Minas Gerais (NYSE:CIG) has seen an increase in hedge fund interest lately. CIG was in 7 hedge funds’ portfolios at the end of the fourth quarter of 2018. There were 6 hedge funds in our database with CIG positions at the end of the previous quarter. Our calculations also showed that CIG isn’t among the 30 most popular stocks among hedge funds.

In the eyes of most traders, hedge funds are perceived as slow, outdated financial vehicles of the past. While there are over 8000 funds with their doors open at the moment, Our experts hone in on the crème de la crème of this group, about 750 funds. These hedge fund managers handle the majority of the hedge fund industry’s total asset base, and by following their matchless investments, Insider Monkey has determined various investment strategies that have historically outperformed the market. Insider Monkey’s flagship hedge fund strategy defeated the S&P 500 index by nearly 5 percentage points a year since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

Cliff Asness of AQR Capital Management

We’re going to take a look at the new hedge fund action regarding Companhia Energética de Minas Gerais (NYSE:CIG).

How have hedgies been trading Companhia Energética de Minas Gerais (NYSE:CIG)?

At Q4’s end, a total of 7 of the hedge funds tracked by Insider Monkey were long this stock, a change of 17% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards CIG over the last 14 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Companhia Energética de Minas Gerais (NYSE:CIG) was held by AQR Capital Management, which reported holding $9.5 million worth of stock at the end of September. It was followed by Millennium Management with a $2 million position. Other investors bullish on the company included Two Sigma Advisors, Renaissance Technologies, and Citadel Investment Group.

Consequently, key money managers were leading the bulls’ herd. Renaissance Technologies, managed by Jim Simons, assembled the largest position in Companhia Energética de Minas Gerais (NYSE:CIG). Renaissance Technologies had $0.4 million invested in the company at the end of the quarter. Matthew Hulsizer’s PEAK6 Capital Management also made a $0.3 million investment in the stock during the quarter. The only other fund with a new position in the stock is Ken Griffin’s Citadel Investment Group.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Companhia Energética de Minas Gerais (NYSE:CIG) but similarly valued. These stocks are James Hardie Industries plc (NYSE:JHX), Logitech International SA (NASDAQ:LOGI), Haemonetics Corporation (NYSE:HAE), and AngloGold Ashanti Limited (NYSE:AU). All of these stocks’ market caps are similar to CIG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| JHX | 2 | 3804 | 0 |

| LOGI | 14 | 160893 | -5 |

| HAE | 20 | 566902 | -2 |

| AU | 12 | 322457 | 2 |

| Average | 12 | 263514 | -1.25 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12 hedge funds with bullish positions and the average amount invested in these stocks was $264 million. That figure was $14 million in CIG’s case. Haemonetics Corporation (NYSE:HAE) is the most popular stock in this table. On the other hand James Hardie Industries plc (NYSE:JHX) is the least popular one with only 2 bullish hedge fund positions. Companhia Energética de Minas Gerais (NYSE:CIG) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks among hedge funds returned 21.3% through April 8th and outperformed the S&P 500 ETF (SPY) by more than 5 percentage points. Unfortunately CIG wasn’t in this group. Hedge funds that bet on CIG were disappointed as the stock returned 4.2% and underperformed the market. If you are interested in investing in large cap stocks, you should check out the top 15 hedge fund stocks as 12 of these outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.