We at Insider Monkey have gone over 700 13F filings that hedge funds and prominent investors are required to file by the SEC The 13F filings show the funds’ and investors’ portfolio positions as of December 31st. In this article, we look at what those funds think of Celestica Inc. (NYSE:CLS) based on that data.

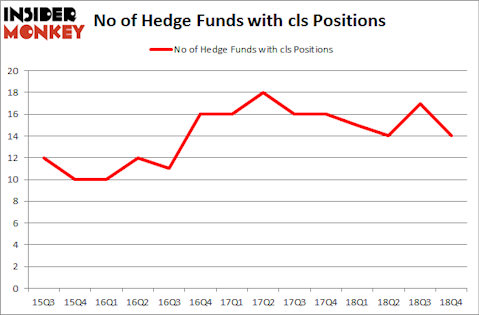

Celestica Inc. (NYSE:CLS) was in 14 hedge funds’ portfolios at the end of the fourth quarter of 2018. CLS shareholders have witnessed a decrease in support from the world’s most elite money managers of late. There were 17 hedge funds in our database with CLS holdings at the end of the previous quarter. Our calculations also showed that cls isn’t among the 30 most popular stocks among hedge funds.

In the financial world there are a multitude of tools market participants can use to analyze stocks. A duo of the most useful tools are hedge fund and insider trading activity. Our researchers have shown that, historically, those who follow the top picks of the top investment managers can trounce the S&P 500 by a very impressive margin (see the details here).

Let’s take a look at the key hedge fund action surrounding Celestica Inc. (NYSE:CLS).

How have hedgies been trading Celestica Inc. (NYSE:CLS)?

At Q4’s end, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -18% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CLS over the last 14 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their holdings meaningfully (or already accumulated large positions).

More specifically, Pzena Investment Management was the largest shareholder of Celestica Inc. (NYSE:CLS), with a stake worth $24.5 million reported as of the end of December. Trailing Pzena Investment Management was Royce & Associates, which amassed a stake valued at $15.7 million. Hawk Ridge Management, Lakewood Capital Management, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that Celestica Inc. (NYSE:CLS) has witnessed bearish sentiment from hedge fund managers, we can see that there was a specific group of money managers that slashed their full holdings heading into Q3. It’s worth mentioning that Glenn W. Welling’s Engaged Capital dumped the largest stake of all the hedgies tracked by Insider Monkey, valued at close to $15.6 million in stock. Jim Simons’s fund, Renaissance Technologies, also sold off its stock, about $1.5 million worth. These moves are interesting, as aggregate hedge fund interest dropped by 3 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Celestica Inc. (NYSE:CLS) but similarly valued. We will take a look at Electro Scientific Industries, Inc. (NASDAQ:ESIO), TriCo Bancshares (NASDAQ:TCBK), LGI Homes Inc (NASDAQ:LGIH), and Internet Initiative Japan Inc. (NASDAQ:IIJI). This group of stocks’ market values resemble CLS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESIO | 17 | 197164 | 4 |

| TCBK | 10 | 38939 | -1 |

| LGIH | 12 | 68829 | 0 |

| IIJI | 2 | 5123 | 0 |

| Average | 10.25 | 77514 | 0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 10.25 hedge funds with bullish positions and the average amount invested in these stocks was $78 million. That figure was $100 million in CLS’s case. Electro Scientific Industries, Inc. (NASDAQ:ESIO) is the most popular stock in this table. On the other hand Internet Initiative Japan Inc. (NASDAQ:IIJI) is the least popular one with only 2 bullish hedge fund positions. Celestica Inc. (NYSE:CLS) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 15 most popular stocks) among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Unfortunately CLS wasn’t nearly as popular as these 15 stock and hedge funds that were betting on CLS were disappointed as the stock returned -1.4% and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 15 most popular stocks) among hedge funds as 13 of these stocks already outperformed the market this year.

Disclosure: None. This article was originally published at Insider Monkey.