Before we spend days researching a stock idea we like to take a look at how hedge funds and billionaire investors recently traded that stock. Russell 2000 ETF (IWM) lagged the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of the third quarter of 2018. This means hedge funds that are allocating a higher percentage of their portfolio to small-cap stocks were probably underperforming the market. However, this also means that as small-cap stocks start to mean revert, these hedge funds will start delivering better returns than the S&P 500 Index funds. In this article, we will take a look at what hedge funds think about Celestica Inc. (NYSE:CLS).

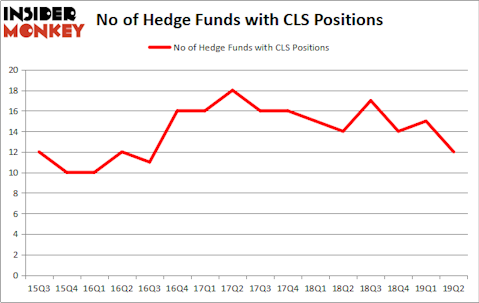

Is Celestica Inc. (NYSE:CLS) the right pick for your portfolio? The best stock pickers are in a pessimistic mood. The number of bullish hedge fund positions went down by 3 in recent months. Our calculations also showed that CLS isn’t among the 30 most popular stocks among hedge funds (see the video below). CLS was in 12 hedge funds’ portfolios at the end of the second quarter of 2019. There were 15 hedge funds in our database with CLS positions at the end of the previous quarter.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

In today’s marketplace there are a large number of gauges market participants have at their disposal to grade stocks. A pair of the most useful gauges are hedge fund and insider trading signals. We have shown that, historically, those who follow the top picks of the elite hedge fund managers can outperform their index-focused peers by a significant margin (see the details here).

Unlike former hedge manager, Dr. Steve Sjuggerud, who is convinced Dow will soar past 40000, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. We’re going to go over the fresh hedge fund action regarding Celestica Inc. (NYSE:CLS).

What does smart money think about Celestica Inc. (NYSE:CLS)?

Heading into the third quarter of 2019, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -20% from the first quarter of 2019. The graph below displays the number of hedge funds with bullish position in CLS over the last 16 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Pzena Investment Management, managed by Richard S. Pzena, holds the biggest position in Celestica Inc. (NYSE:CLS). Pzena Investment Management has a $32 million position in the stock, comprising 0.2% of its 13F portfolio. Coming in second is Hawk Ridge Management, managed by David Brown, which holds a $11.7 million position; 2.2% of its 13F portfolio is allocated to the company. Some other professional money managers that are bullish contain Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital, D. E. Shaw’s D E Shaw and Michael M. Rothenberg’s Moab Capital Partners.

Judging by the fact that Celestica Inc. (NYSE:CLS) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there is a sect of hedge funds that elected to cut their positions entirely last quarter. At the top of the heap, Chuck Royce’s Royce & Associates cut the largest stake of all the hedgies followed by Insider Monkey, valued at close to $16.8 million in stock. Renaissance Technologies also said goodbye to its stock, about $1.1 million worth. These transactions are intriguing to say the least, as aggregate hedge fund interest dropped by 3 funds last quarter.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Celestica Inc. (NYSE:CLS) but similarly valued. These stocks are Bitauto Hldg Ltd (NYSE:BITA), AngioDynamics, Inc. (NASDAQ:ANGO), SunCoke Energy, Inc (NYSE:SXC), and Realogy Holdings Corp (NYSE:RLGY). All of these stocks’ market caps resemble CLS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| BITA | 7 | 11117 | 0 |

| ANGO | 12 | 37423 | -1 |

| SXC | 20 | 137167 | -1 |

| RLGY | 24 | 299862 | -4 |

| Average | 15.75 | 121392 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $121 million. That figure was $61 million in CLS’s case. Realogy Holdings Corp (NYSE:RLGY) is the most popular stock in this table. On the other hand Bitauto Hldg Ltd (NYSE:BITA) is the least popular one with only 7 bullish hedge fund positions. Celestica Inc. (NYSE:CLS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on CLS, though not to the same extent, as the stock returned 5% during the third quarter and outperformed the market.

Disclosure: None. This article was originally published at Insider Monkey.