The first quarter was a breeze as Powell pivoted, and China seemed eager to reach a deal with Trump. Both the S&P 500 and Russell 2000 delivered very strong gains as a result, with the Russell 2000, which is composed of smaller companies, outperforming the large-cap stocks slightly during the first quarter. Unfortunately sentiment shifted in May and August as this time China pivoted and Trump put more pressure on China by increasing tariffs. Fourth quarter brought optimism to the markets and hedge funds’ top 20 stock picks performed spectacularly in this volatile environment. These stocks delivered a total gain of 37.4% through the end of November, vs. a gain of 27.5% for the S&P 500 ETF. In this article we will look at how this market volatility affected the sentiment of hedge funds towards Capital Product Partners L.P. (NASDAQ:CPLP), and what that likely means for the prospects of the company and its stock.

Capital Product Partners L.P. (NASDAQ:CPLP) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 5 hedge funds’ portfolios at the end of the third quarter of 2019. At the end of this article we will also compare CPLP to other stocks including Misonix, Inc. (NASDAQ:MSON), Allegro Merger Corp. (NASDAQ:ALGR), and Evolution Petroleum Corporation (NYSE:EPM) to get a better sense of its popularity.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

At the moment there are many tools stock traders can use to analyze stocks. A couple of the most innovative tools are hedge fund and insider trading interest. Our experts have shown that, historically, those who follow the best picks of the best investment managers can outpace the market by a significant margin (see the details here).

Howard Marks of Oaktree Capital Management

We leave no stone unturned when looking for the next great investment idea. For example Discover is offering this insane cashback card, so we look into shorting the stock. One of the most bullish analysts in America just put his money where his mouth is. He says, “I’m investing more today than I did back in early 2009.” So we check out his pitch. We read hedge fund investor letters and listen to stock pitches at hedge fund conferences. We even check out this option genius’ weekly trade ideas. This December, we recommended Adams Energy as a one-way bet based on an under-the-radar fund manager’s investor letter and the stock already gained 20 percent. Now let’s go over the new hedge fund action encompassing Capital Product Partners L.P. (NASDAQ:CPLP).

What does smart money think about Capital Product Partners L.P. (NASDAQ:CPLP)?

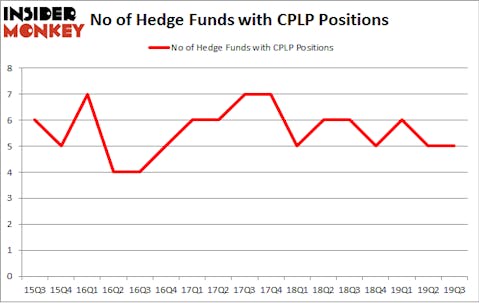

Heading into the fourth quarter of 2019, a total of 5 of the hedge funds tracked by Insider Monkey were long this stock, a change of 0% from the second quarter of 2019. The graph below displays the number of hedge funds with bullish position in CPLP over the last 17 quarters. With the smart money’s capital changing hands, there exists a few notable hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Arrowstreet Capital was the largest shareholder of Capital Product Partners L.P. (NASDAQ:CPLP), with a stake worth $2.9 million reported as of the end of September. Trailing Arrowstreet Capital was Oaktree Capital Management, which amassed a stake valued at $0.3 million. Two Sigma Advisors, Millennium Management, and Citadel Investment Group were also very fond of the stock, becoming one of the largest hedge fund holders of the company. In terms of the portfolio weights assigned to each position Arrowstreet Capital allocated the biggest weight to Capital Product Partners L.P. (NASDAQ:CPLP), around 0.01% of its 13F portfolio. Oaktree Capital Management is also relatively very bullish on the stock, designating 0.01 percent of its 13F equity portfolio to CPLP.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Renaissance Technologies. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was Citadel Investment Group).

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as Capital Product Partners L.P. (NASDAQ:CPLP) but similarly valued. We will take a look at Misonix, Inc. (NASDAQ:MSON), Allegro Merger Corp. (NASDAQ:ALGR), Evolution Petroleum Corporation (NYSE:EPM), and Griffin Industrial Realty, Inc. (NASDAQ:GRIF). This group of stocks’ market values are similar to CPLP’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MSON | 3 | 6147 | 0 |

| ALGR | 11 | 23423 | 0 |

| EPM | 12 | 20409 | -2 |

| GRIF | 2 | 27297 | 0 |

| Average | 7 | 19319 | -0.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 7 hedge funds with bullish positions and the average amount invested in these stocks was $19 million. That figure was $4 million in CPLP’s case. Evolution Petroleum Corporation (NYSE:EPM) is the most popular stock in this table. On the other hand Griffin Industrial Realty, Inc. (NASDAQ:GRIF) is the least popular one with only 2 bullish hedge fund positions. Capital Product Partners L.P. (NASDAQ:CPLP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 37.4% in 2019 through the end of November and outperformed the S&P 500 ETF (SPY) by 9.9 percentage points. A small number of hedge funds were also right about betting on CPLP as the stock returned 10.8% during the first two months of Q4 and outperformed the market by an even larger margin.

Disclosure: None. This article was originally published at Insider Monkey.