Hedge funds and other investment firms run by legendary investors like Israel Englander and Ray Dalio are entrusted to manage billions of dollars of accredited investors’ money because they are without peer in the resources they use to identify the best investments for their chosen investment horizon. Moreover, they are more willing to invest a greater amount of their resources in small-cap stocks than big brokerage houses, and this is often where they generate their outperformance, which is why we pay particular attention to their best ideas in this space.

Camping World Holdings, Inc. (NYSE:CWH) shares haven’t seen a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 17 hedge funds’ portfolios at the end of September, which was far from enough for it to be considered as one of 30 most popular stocks among hedge funds in Q3 of 2018. In any case, we need more analysis of the stock in order to determine if it is a good buy, hence, at the end of this article we will also compare CWH to other stocks including FBL Financial Group (NYSE:FFG), Innospec Inc. (NASDAQ:IOSP), and Kaman Corporation (NYSE:KAMN), to get a better sense of its popularity.

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 17.4% year to date and outperformed the market by more than 14 percentage points this year. This strategy also outperformed the market by 3 percentage points in the fourth quarter despite the market volatility (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

While researching the stock further, we found Upslope Capital Management’s Q3 Update letter, in which this investment adviser talks about its position in the company. We bring you that part of the letter:

“New Long – Camping World Holdings (CWH): We were previously short CWH (closed in April), the largest RV dealer in the U.S. The stock took another leg lower after we exited. Our short thesis was that CWH had been trading at a full valuation on estimates likely reflecting a peak for the sector. As a bonus, CWH was (still is) run by a ‘CNBC personality’ (Marcus Lemonis) – a factor we assumed might bother investors in a downturn. While not all of the factors have changed, a few key items have:

CWH’s stock and earnings multiple have both been cut in half. The prices of other stocks across the sector have also been hit hard (down 10-50% YTD). All in all, expectations around the RV cycle appear to have been

The CEO has finally fumbled his way towards a logical explanation of CWH’s Gander Mountain Gander Mountain was a bankrupt outdoor retailer that CWH initially pitched as an easy way for CWH to add to its customer database. Eventually, the strategy “evolved” and CWH noted the deal would enable it to efficiently add new dealer locations in under-penetrated markets. This confusion/messaging change had been a sticking point for investors.

A well-known and sometimes-activist fund, Third Point, took a stake in Q2. We don’t necessarily expect them to “go activist” here, given the relative But, their presence seems a marginal positive at worst.

Short interest has surged: CWH is one of the most shorted stocks of any we look at (~50% short interest as a percent of float). We don’t automatically view this as a positive. But, given the above commentary, it’s not hard to envision CWH meeting/beating low expectations and the extreme level of short interest providing fuel for the CWH isn’t perfect and we still have a few lingering concerns (Lemonis, being long a “cheap” cyclical, missing something regarding short interest). Nonetheless, CWH represents a compelling risk-reward, in our view. The company maintains a dominant competitive position in an industry likely to grow over the long-term. The business model – similar to auto dealers in that profitability is more driven by recurring services than unit sales – is an attractive one. Valuation, by virtually any metric, is near all- time lows. Free cash flow is likely to be solid through the cycle. And finally, despite some lingering skepticism towards Lemonis, we are comforted by the fact he remains the largest shareholder by far.“

Continuing with our analysis, we’ll take a gander at the latest hedge fund action regarding Camping World Holdings, Inc. (NYSE:CWH).

What have hedge funds been doing with Camping World Holdings, Inc. (NYSE:CWH)?

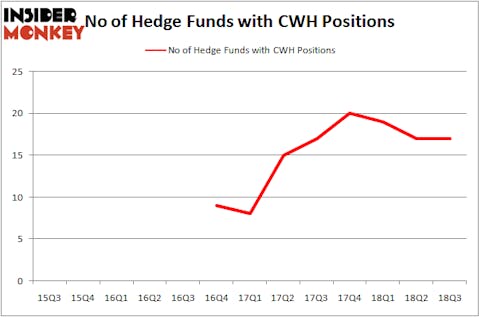

At the end of the third quarter, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from the previous quarter. The graph below displays the number of hedge funds with bullish position in CWH over the last 13 quarters. So, let’s examine which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, David Abrams’s Abrams Capital Management has the number one position in Camping World Holdings, Inc. (NYSE:CWH), worth close to $49.6 million, comprising 1.3% of its total 13F portfolio. Coming in second is Royce & Associates, managed by Chuck Royce, which holds a $28.5 million position; the fund has 0.2% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors with similar optimism comprise Joshua Kaufman and Craig Nerenberg’s Brenner West Capital Partners, Josh Donfeld and David Rogers’s Castle Hook Partners and David Rosen’s Rubric Capital Management.

Judging by the fact that Camping World Holdings, Inc. (NYSE:CWH) has faced falling interest from the entirety of the hedge funds we track, logic holds that there was a specific group of fund managers who sold off their positions entirely last quarter. At the top of the heap, Dan Loeb’s Third Point said goodbye to the biggest stake of the “upper crust” of funds followed by Insider Monkey, valued at close to $70.6 million in stock, and Clint Carlson’s Carlson Capital was right behind this move, as the fund dropped about $20.8 million worth. These transactions are intriguing to say the least, as total hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s go over hedge fund activity in other stocks similar to Camping World Holdings, Inc. (NYSE:CWH). These stocks are FBL Financial Group, Inc. (NYSE:FFG), Innospec Inc. (NASDAQ:IOSP), Kaman Corporation (NYSE:KAMN), and Agree Realty Corporation (NYSE:ADC). This group of stocks’ market valuations match CWH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| FFG | 4 | 8943 | -1 |

| IOSP | 12 | 69551 | -1 |

| KAMN | 20 | 320855 | 4 |

| ADC | 14 | 71333 | 2 |

As you can see these stocks had an average of 13 hedge funds with bullish positions and the average amount invested in these stocks was $118 million. That figure was $158 million in CWH’s case. Kaman Corporation (NYSE:KAMN) is the most popular stock in this table. On the other hand FBL Financial Group, Inc. (NYSE:FFG) is the least popular one with only 4 bullish hedge fund positions. Camping World Holdings, Inc. (NYSE:CWH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard KAMN might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.