Legendary investors such as Jeffrey Talpins and Seth Klarman earn enormous amounts of money for themselves and their investors by doing in-depth research on small-cap stocks that big brokerage houses don’t publish. Small cap stocks -especially when they are screened well- can generate substantial outperformance versus a boring index fund. That’s why we analyze the activity of those elite funds in these small-cap stocks. In the following paragraphs, we analyze Cadence Design Systems Inc (NASDAQ:CDNS) from the perspective of those elite funds.

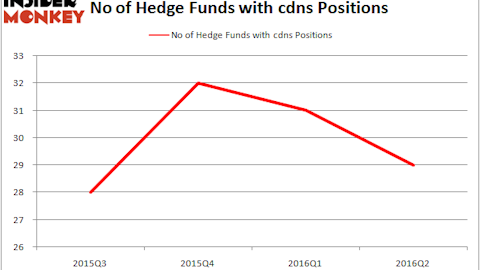

Cadence Design Systems Inc (NASDAQ:CDNS) has experienced a decrease in enthusiasm from smart money recently. CDNS was in 29 hedge funds’ portfolios at the end of December. There were 32 hedge funds in our database with CDNS holdings at the end of the previous quarter. Our calculations also showed that CDNS isn’t among the 30 most popular stocks among hedge funds.

To most shareholders, hedge funds are seen as worthless, old investment vehicles of the past. While there are greater than 8000 funds with their doors open today, Our researchers hone in on the top tier of this club, around 750 funds. It is estimated that this group of investors handle most of the hedge fund industry’s total asset base, and by observing their best equity investments, Insider Monkey has identified a number of investment strategies that have historically defeated the market. Insider Monkey’s flagship hedge fund strategy outstripped the S&P 500 index by nearly 5 percentage points annually since its inception in May 2014 through early November 2018. We were able to generate large returns even by identifying short candidates. Our portfolio of short stocks lost 27.5% since February 2017 (through March 12th) even though the market was up nearly 25% during the same period. We just shared a list of 6 short targets in our latest quarterly update and they are already down an average of 6% in less than a month.

We’re going to check out the key hedge fund action encompassing Cadence Design Systems Inc (NASDAQ:CDNS).

What have hedge funds been doing with Cadence Design Systems Inc (NASDAQ:CDNS)?

Heading into the first quarter of 2019, a total of 29 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -9% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in CDNS over the last 14 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Cadence Design Systems Inc (NASDAQ:CDNS) was held by Alkeon Capital Management, which reported holding $275 million worth of stock at the end of September. It was followed by AQR Capital Management with a $166.1 million position. Other investors bullish on the company included GLG Partners, Millennium Management, and Renaissance Technologies.

Due to the fact that Cadence Design Systems Inc (NASDAQ:CDNS) has faced bearish sentiment from the smart money, it’s safe to say that there lies a certain “tier” of hedge funds who sold off their positions entirely heading into Q3. Intriguingly, Zach Schreiber’s Point State Capital dumped the largest investment of the 700 funds watched by Insider Monkey, worth about $36.4 million in stock, and George Hall’s Clinton Group was right behind this move, as the fund sold off about $1.1 million worth. These transactions are interesting, as aggregate hedge fund interest dropped by 3 funds heading into Q3.

Let’s now review hedge fund activity in other stocks similar to Cadence Design Systems Inc (NASDAQ:CDNS). These stocks are Teck Resources Ltd (NYSE:TECK), CDW Corporation (NASDAQ:CDW), The Liberty SiriusXM Group (NASDAQ:LSXMK), and Discovery, Inc. (NASDAQ:DISCK). This group of stocks’ market caps match CDNS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TECK | 26 | 1011650 | -9 |

| CDW | 26 | 861436 | -2 |

| LSXMK | 45 | 2694663 | -3 |

| DISCK | 34 | 778837 | 0 |

| Average | 32.75 | 1336647 | -3.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 32.75 hedge funds with bullish positions and the average amount invested in these stocks was $1337 million. That figure was $1178 million in CDNS’s case. The Liberty SiriusXM Group (NASDAQ:LSXMK) is the most popular stock in this table. On the other hand Teck Resources Ltd (NYSE:TECK) is the least popular one with only 26 bullish hedge fund positions. Cadence Design Systems Inc (NASDAQ:CDNS) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 15 most popular stocks among hedge funds returned 19.7% through March 15th and outperformed the S&P 500 ETF (SPY) by 6.6 percentage points. Some hedge funds were also right about betting on CDNS as the stock returned 40.1% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.