The 700+ hedge funds and famous money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the first quarter, which unveil their equity positions as of March 31. We went through these filings, fixed typos and other more significant errors and identified the changes in hedge fund portfolios. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards BlackBerry Limited (NYSE:BB).

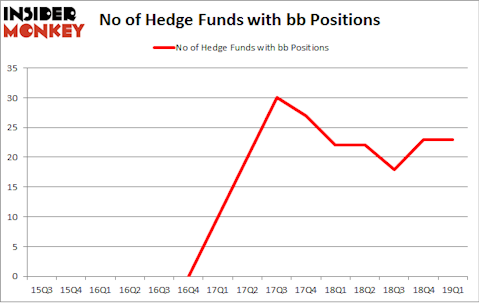

BlackBerry Limited (NYSE:BB) shares haven’t seen a lot of action during the first quarter. Overall, hedge fund sentiment was unchanged. The stock was in 23 hedge funds’ portfolios at the end of the first quarter of 2019. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Elbit Systems Ltd. (NASDAQ:ESLT), YPF Sociedad Anonima (NYSE:YPF), and Arris International plc (NASDAQ:ARRS) to gather more data points.

In the financial world there are plenty of indicators investors have at their disposal to size up publicly traded companies. A duo of the best indicators are hedge fund and insider trading moves. Our experts have shown that, historically, those who follow the best picks of the top hedge fund managers can trounce the broader indices by a healthy margin (see the details here).

We’re going to take a peek at the recent hedge fund action surrounding BlackBerry Limited (NYSE:BB).

What does the smart money think about BlackBerry Limited (NYSE:BB)?

At the end of the first quarter, a total of 23 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 0% from one quarter earlier. On the other hand, there were a total of 22 hedge funds with a bullish position in BB a year ago. With hedgies’ sentiment swirling, there exists a select group of key hedge fund managers who were increasing their stakes meaningfully (or already accumulated large positions).

More specifically, Fairfax Financial Holdings was the largest shareholder of BlackBerry Limited (NYSE:BB), with a stake worth $471.3 million reported as of the end of March. Trailing Fairfax Financial Holdings was Renaissance Technologies, which amassed a stake valued at $42.8 million. D E Shaw, Citadel Investment Group, and AQR Capital Management were also very fond of the stock, giving the stock large weights in their portfolios.

Judging by the fact that BlackBerry Limited (NYSE:BB) has witnessed a decline in interest from hedge fund managers, it’s safe to say that there lies a certain “tier” of money managers that decided to sell off their positions entirely in the third quarter. It’s worth mentioning that David Cohen and Harold Levy’s Iridian Asset Management cut the largest position of the 700 funds tracked by Insider Monkey, totaling close to $99.4 million in stock. Irving Kahn’s fund, Kahn Brothers, also said goodbye to its stock, about $32.6 million worth. These bearish behaviors are important to note, as aggregate hedge fund interest stayed the same (this is a bearish signal in our experience).

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as BlackBerry Limited (NYSE:BB) but similarly valued. We will take a look at Elbit Systems Ltd. (NASDAQ:ESLT), YPF Sociedad Anonima (NYSE:YPF), Arris International plc (NASDAQ:ARRS), and Versum Materials, Inc. (NYSE:VSM). This group of stocks’ market values match BB’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| ESLT | 2 | 13053 | -1 |

| YPF | 21 | 113069 | 6 |

| ARRS | 32 | 1197682 | -7 |

| VSM | 43 | 1090671 | 14 |

| Average | 24.5 | 603619 | 3 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 24.5 hedge funds with bullish positions and the average amount invested in these stocks was $604 million. That figure was $667 million in BB’s case. Versum Materials, Inc. (NYSE:VSM) is the most popular stock in this table. On the other hand Elbit Systems Ltd. (NASDAQ:ESLT) is the least popular one with only 2 bullish hedge fund positions. BlackBerry Limited (NYSE:BB) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. Our calculations showed that top 20 most popular stocks among hedge funds returned 1.9% in Q2 through May 30th and outperformed the S&P 500 ETF (SPY) by more than 3 percentage points. Unfortunately BB wasn’t nearly as popular as these 20 stocks (hedge fund sentiment was quite bearish); BB investors were disappointed as the stock returned -21.5% during the same time period and underperformed the market. If you are interested in investing in large cap stocks with huge upside potential, you should check out the top 20 most popular stocks among hedge funds as 13 of these stocks already outperformed the market so far in Q2.

Disclosure: None. This article was originally published at Insider Monkey.