Out of thousands of stocks that are currently traded on the market, it is difficult to identify those that will really generate strong returns. Hedge funds and institutional investors spend millions of dollars on analysts with MBAs and PhDs, who are industry experts and well connected to other industry and media insiders on top of that. Individual investors can piggyback the hedge funds employing these talents and can benefit from their vast resources and knowledge in that way. We analyze quarterly 13F filings of nearly 900 hedge funds and, by looking at the smart money sentiment that surrounds a stock, we can determine whether it has the potential to beat the market over the long-term. Therefore, let’s take a closer look at what smart money thinks about Axcelis Technologies Inc (NASDAQ:ACLS).

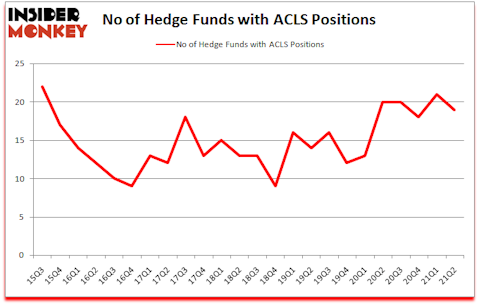

Axcelis Technologies Inc (NASDAQ:ACLS) shareholders have witnessed a decrease in activity from the world’s largest hedge funds in recent months. Axcelis Technologies Inc (NASDAQ:ACLS) was in 19 hedge funds’ portfolios at the end of the second quarter of 2021. The all time high for this statistic is 22. Our calculations also showed that ACLS isn’t among the 30 most popular stocks among hedge funds (click for Q2 rankings).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s monthly stock picks returned 185.4% since March 2017 and outperformed the S&P 500 ETFs by more than 79 percentage points (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Peter Rathjens of Arrowstreet Capital

Now let’s go over the fresh hedge fund action encompassing Axcelis Technologies Inc (NASDAQ:ACLS).

Do Hedge Funds Think ACLS Is A Good Stock To Buy Now?

At the end of the second quarter, a total of 19 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -10% from the previous quarter. On the other hand, there were a total of 20 hedge funds with a bullish position in ACLS a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, Richard Mashaal’s Rima Senvest Management has the biggest position in Axcelis Technologies Inc (NASDAQ:ACLS), worth close to $70.6 million, accounting for 2.1% of its total 13F portfolio. The second largest stake is held by Royce & Associates, managed by Chuck Royce, which holds a $38.4 million position; the fund has 0.3% of its 13F portfolio invested in the stock. Some other professional money managers that hold long positions contain Richard Driehaus’s Driehaus Capital, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Israel Englander’s Millennium Management. In terms of the portfolio weights assigned to each position Rima Senvest Management allocated the biggest weight to Axcelis Technologies Inc (NASDAQ:ACLS), around 2.06% of its 13F portfolio. Quantinno Capital is also relatively very bullish on the stock, setting aside 0.5 percent of its 13F equity portfolio to ACLS.

Due to the fact that Axcelis Technologies Inc (NASDAQ:ACLS) has faced declining sentiment from the aggregate hedge fund industry, it’s safe to say that there exists a select few fund managers that elected to cut their positions entirely heading into Q3. Intriguingly, Paul Holland and Matthew Miller’s Glaxis Capital Management sold off the largest stake of all the hedgies watched by Insider Monkey, comprising about $2.1 million in stock. Noam Gottesman’s fund, GLG Partners, also sold off its stock, about $0.4 million worth. These moves are interesting, as total hedge fund interest fell by 2 funds heading into Q3.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Axcelis Technologies Inc (NASDAQ:ACLS) but similarly valued. We will take a look at MannKind Corporation (NASDAQ:MNKD), Lands’ End, Inc. (NASDAQ:LE), First Commonwealth Financial Corporation (NYSE:FCF), Stock Yards Bancorp, Inc. (NASDAQ:SYBT), Schnitzer Steel Industries, Inc. (NASDAQ:SCHN), Precigen, Inc. (NASDAQ:PGEN), and Prelude Therapeutics Incorporated (NASDAQ:PRLD). This group of stocks’ market values match ACLS’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MNKD | 13 | 97516 | 1 |

| LE | 16 | 114015 | 4 |

| FCF | 12 | 23069 | -1 |

| SYBT | 8 | 8150 | 3 |

| SCHN | 18 | 19927 | 6 |

| PGEN | 13 | 131743 | -4 |

| PRLD | 6 | 866870 | -1 |

| Average | 12.3 | 180184 | 1.1 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 12.3 hedge funds with bullish positions and the average amount invested in these stocks was $180 million. That figure was $183 million in ACLS’s case. Schnitzer Steel Industries, Inc. (NASDAQ:SCHN) is the most popular stock in this table. On the other hand Prelude Therapeutics Incorporated (NASDAQ:PRLD) is the least popular one with only 6 bullish hedge fund positions. Compared to these stocks Axcelis Technologies Inc (NASDAQ:ACLS) is more popular among hedge funds. Our overall hedge fund sentiment score for ACLS is 78.9. Stocks with higher number of hedge fund positions relative to other stocks as well as relative to their historical range receive a higher sentiment score. Our calculations showed that top 5 most popular stocks among hedge funds returned 95.8% in 2019 and 2020, and outperformed the S&P 500 ETF (SPY) by 40 percentage points. These stocks returned 24% in 2021 through October 22nd but still managed to beat the market by 1.6 percentage points. Hedge funds were also right about betting on ACLS as the stock returned 21.9% since the end of June (through 10/22) and outperformed the market by an even larger margin. Hedge funds were clearly right about piling into this stock relative to other stocks with similar market capitalizations.

Follow Axcelis Technologies Inc (NASDAQ:ACLS)

Follow Axcelis Technologies Inc (NASDAQ:ACLS)

Receive real-time insider trading and news alerts

Suggested Articles:

Disclosure: None. This article was originally published at Insider Monkey.