With the third-quarter round of 13F filings behind us it is time to take a look at the stocks in which some of the best money managers in the world preferred to invest or sell heading into the fourth quarter. One of these stocks was Anixter International Inc. (NYSE:AXE).

Is Anixter International Inc. (NYSE:AXE) going to take off soon? Prominent investors are getting more optimistic. The number of long hedge fund bets rose by 2 recently. Our calculations also showed that AXE isn’t among the 30 most popular stocks among hedge funds.

So, why do we pay attention to hedge fund sentiment before making any investment decisions? Our research has shown that hedge funds’ small-cap stock picks managed to beat the market by double digits annually between 1999 and 2016, but the margin of outperformance has been declining in recent years. Nevertheless, we were still able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that underperformed the market by 10 percentage points annually between 2006 and 2017. Interestingly the margin of underperformance of these stocks has been increasing in recent years. Investors who are long the market and short these stocks would have returned more than 27% annually between 2015 and 2017. We have been tracking and sharing the list of these stocks since February 2017 in our quarterly newsletter. Even if you aren’t comfortable with shorting stocks, you should at least avoid initiating long positions in our short portfolio.

We’re going to take a gander at the fresh hedge fund action encompassing Anixter International Inc. (NYSE:AXE).

What have hedge funds been doing with Anixter International Inc. (NYSE:AXE)?

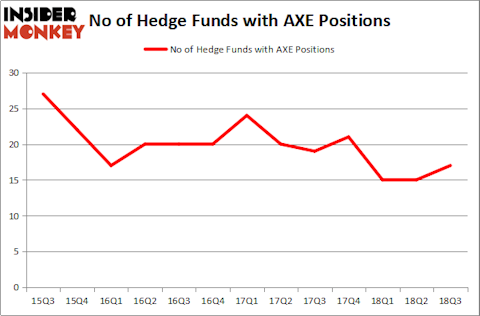

Heading into the fourth quarter of 2018, a total of 17 of the hedge funds tracked by Insider Monkey were long this stock, a change of 13% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in AXE over the last 13 quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were adding to their holdings considerably (or already accumulated large positions).

More specifically, Pzena Investment Management was the largest shareholder of Anixter International Inc. (NYSE:AXE), with a stake worth $137.8 million reported as of the end of September. Trailing Pzena Investment Management was Ariel Investments, which amassed a stake valued at $77.7 million. Fisher Asset Management, Royce & Associates, and D E Shaw were also very fond of the stock, giving the stock large weights in their portfolios.

As industrywide interest jumped, specific money managers have jumped into Anixter International Inc. (NYSE:AXE) headfirst. PEAK6 Capital Management, managed by Matthew Hulsizer, initiated the biggest call position in Anixter International Inc. (NYSE:AXE). PEAK6 Capital Management had $1.2 million invested in the company at the end of the quarter. Michael Platt and William Reeves’s BlueCrest Capital Mgmt. also made a $0.3 million investment in the stock during the quarter. The other funds with new positions in the stock are Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital, John Overdeck and David Siegel’s Two Sigma Advisors, and Gavin Saitowitz and Cisco J. del Valle’s Springbok Capital.

Let’s go over hedge fund activity in other stocks similar to Anixter International Inc. (NYSE:AXE). These stocks are California Resources Corporation (NYSE:CRC), Cal-Maine Foods Inc (NASDAQ:CALM), Yext, Inc. (NYSE:YEXT), and El Paso Electric Company (NYSE:EE). This group of stocks’ market values are closest to AXE’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRC | 22 | 414123 | -1 |

| CALM | 21 | 190329 | 1 |

| YEXT | 16 | 203971 | 2 |

| EE | 15 | 308083 | 4 |

| Average | 18.5 | 279127 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 18.5 hedge funds with bullish positions and the average amount invested in these stocks was $279 million. That figure was $319 million in AXE’s case. California Resources Corporation (NYSE:CRC) is the most popular stock in this table. On the other hand El Paso Electric Company (NYSE:EE) is the least popular one with only 15 bullish hedge fund positions. Anixter International Inc. (NYSE:AXE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CRC might be a better candidate to consider a long position.

Disclosure: None. This article was originally published at Insider Monkey.