Hedge funds and large money managers usually invest with a focus on the long-term horizon and, therefore, short-lived dips on the charts, usually don’t make them change their opinion towards a company. The second half of 2015 and the first few months of this year was a stressful period for hedge funds. However, things have been taking a turn for the better in the second half of this year. Small-cap stocks which hedge funds are usually overweight outperformed the market by double digits and it may be a good time to pay attention to hedge funds’ picks before it is too late. In this article we are going to analyze the hedge fund sentiment towards AmTrust Financial Services Inc (NASDAQ:AFSI) to find out whether it was one of their high conviction long-term ideas.

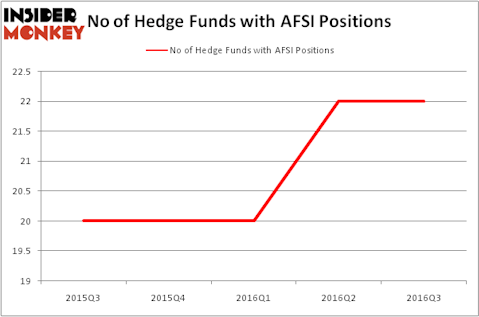

AmTrust Financial Services Inc (NASDAQ:AFSI) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged and there were 22 funds from our database bullish on the company at the end of September. At the end of this article we will also compare AFSI to other stocks including Banco Macro SA (ADR) (NYSE:BMA), AECOM Technology Corp (NYSE:ACM), and Servicemaster Global Holdings Inc (NYSE:SERV) to get a better sense of its popularity.

Follow American Financial Group Inc (NYSE:AFG)

Follow American Financial Group Inc (NYSE:AFG)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

With all of this in mind, we’re going to take a look at the fresh action regarding AmTrust Financial Services Inc (NASDAQ:AFSI).

Hedge fund activity in AmTrust Financial Services Inc (NASDAQ:AFSI)

Heading into the fourth quarter of 2016, a total of 22 of the hedge funds tracked by Insider Monkey were long AmTrust Financial Services, unchanged over the quarter. The graph below displays the number of hedge funds with bullish position in AFSI over the last five quarters. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Matthew Iorio’s White Elm Capital has the number one position in AmTrust Financial Services Inc (NASDAQ:AFSI), worth close to $56.8 million, amounting to 7.2% of its total 13F portfolio. On White Elm Capital’s heels is Ken Griffin’s Citadel Investment Group, with a $33.6 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining peers with similar optimism encompass Cliff Asness’ AQR Capital Management, Peter S. Park’s Park West Asset Management, and Jim Simons’ Renaissance Technologies. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.