Is American Electric Power Company, Inc. (NYSE:AEP) a good equity to bet on right now? We like to check what the smart money thinks first before doing extensive research on a given stock. Although there have been several high profile failed hedge fund picks, the consensus picks among hedge fund investors have historically outperformed the market after adjusting for known risk attributes. It’s not surprising given that hedge funds have access to better information and more resources to predict the winners in the stock market.

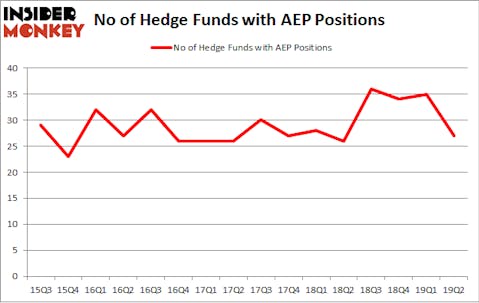

American Electric Power Company, Inc. (NYSE:AEP) was in 27 hedge funds’ portfolios at the end of June. AEP has seen a decrease in support from the world’s most elite money managers recently. There were 35 hedge funds in our database with AEP holdings at the end of the previous quarter. Our calculations also showed that AEP isn’t among the 30 most popular stocks among hedge funds (see the video at the end of this article).

In the financial world there are a large number of tools investors have at their disposal to grade stocks. A pair of the most under-the-radar tools are hedge fund and insider trading indicators. We have shown that, historically, those who follow the top picks of the best fund managers can outperform the broader indices by a solid amount. Insider Monkey’s flagship best performing hedge funds strategy returned 25.8% year to date (through May 30th) and outperformed the market even though it draws its stock picks among small-cap stocks. This strategy also outperformed the market by 40 percentage points since its inception (see the details here). That’s why we believe hedge fund sentiment is a useful indicator that investors should pay attention to.

Unlike some fund managers who are betting on Dow reaching 40000 in a year, our long-short investment strategy doesn’t rely on bull markets to deliver double digit returns. We only rely on hedge fund buy/sell signals. Let’s review the new hedge fund action regarding American Electric Power Company, Inc. (NYSE:AEP).

What does smart money think about American Electric Power Company, Inc. (NYSE:AEP)?

At the end of the second quarter, a total of 27 of the hedge funds tracked by Insider Monkey were long this stock, a change of -23% from the first quarter of 2019. On the other hand, there were a total of 26 hedge funds with a bullish position in AEP a year ago. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in American Electric Power Company, Inc. (NYSE:AEP) was held by Renaissance Technologies, which reported holding $425.7 million worth of stock at the end of March. It was followed by Citadel Investment Group with a $375.3 million position. Other investors bullish on the company included AQR Capital Management, Millennium Management, and Adage Capital Management.

Because American Electric Power Company, Inc. (NYSE:AEP) has faced bearish sentiment from the entirety of the hedge funds we track, logic holds that there were a few fund managers that decided to sell off their entire stakes last quarter. At the top of the heap, Steve Cohen’s Point72 Asset Management sold off the largest position of all the hedgies followed by Insider Monkey, worth close to $20.9 million in stock, and Peter J. Hark’s Shelter Harbor Advisors was right behind this move, as the fund dumped about $10.5 million worth. These transactions are interesting, as total hedge fund interest fell by 8 funds last quarter.

Let’s now review hedge fund activity in other stocks similar to American Electric Power Company, Inc. (NYSE:AEP). These stocks are Micron Technology, Inc. (NASDAQ:MU), Phillips 66 (NYSE:PSX), Equinix Inc (NASDAQ:EQIX), and Telefonica S.A. (NYSE:TEF). This group of stocks’ market caps match AEP’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| MU | 62 | 3048109 | 1 |

| PSX | 39 | 1283214 | -4 |

| EQIX | 38 | 1709515 | 0 |

| TEF | 7 | 44428 | -3 |

| Average | 36.5 | 1521317 | -1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 36.5 hedge funds with bullish positions and the average amount invested in these stocks was $1521 million. That figure was $1483 million in AEP’s case. Micron Technology, Inc. (NASDAQ:MU) is the most popular stock in this table. On the other hand Telefonica S.A. (NYSE:TEF) is the least popular one with only 7 bullish hedge fund positions. American Electric Power Company, Inc. (NYSE:AEP) is not the least popular stock in this group but hedge fund interest is still below average. Our calculations showed that top 20 most popular stocks among hedge funds returned 24.4% in 2019 through September 30th and outperformed the S&P 500 ETF (SPY) by 4 percentage points. A small number of hedge funds were also right about betting on AEP as the stock returned 7.3% during the same time frame and outperformed the market by an even larger margin.

Video: Click the image to watch our video about the top 5 most popular hedge fund stocks.

Disclosure: None. This article was originally published at Insider Monkey.