Hedge funds and other investment firms that we track manage billions of dollars of their wealthy clients’ money, and needless to say, they are painstakingly thorough when analyzing where to invest this money, as their own wealth also depends on it. Regardless of the various methods used by elite investors like David Tepper and David Abrams, the resources they expend are second-to-none. This is especially valuable when it comes to small-cap stocks, which is where they generate their strongest outperformance, as their resources give them a huge edge when it comes to studying these stocks compared to the average investor, which is why we intently follow their activity in the small-cap space.

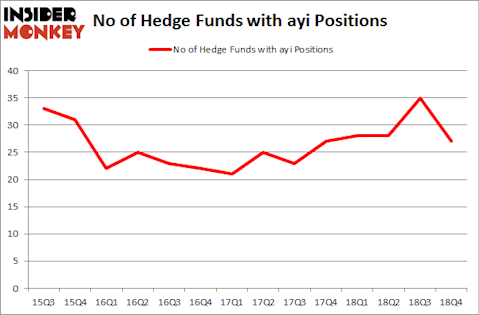

Acuity Brands, Inc. (NYSE:AYI) was in 27 hedge funds’ portfolios at the end of the fourth quarter of 2018. AYI has experienced a decrease in activity from the world’s largest hedge funds recently. There were 35 hedge funds in our database with AYI positions at the end of the previous quarter. Our calculations also showed that ayi isn’t among the 30 most popular stocks among hedge funds.

Hedge funds’ reputation as shrewd investors has been tarnished in the last decade as their hedged returns couldn’t keep up with the unhedged returns of the market indices. Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 32 percentage points since May 2014 through March 12, 2019 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 27.5% through March 12, 2019. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s take a look at the recent hedge fund action surrounding Acuity Brands, Inc. (NYSE:AYI).

What does the smart money think about Acuity Brands, Inc. (NYSE:AYI)?

Heading into the first quarter of 2019, a total of 27 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of -23% from the second quarter of 2018. Below, you can check out the change in hedge fund sentiment towards AYI over the last 14 quarters. With the smart money’s sentiment swirling, there exists a few noteworthy hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Generation Investment Management, managed by David Blood and Al Gore, holds the largest position in Acuity Brands, Inc. (NYSE:AYI). Generation Investment Management has a $385.4 million position in the stock, comprising 3.2% of its 13F portfolio. Coming in second is Charles de Vaulx of International Value Advisers, with a $240.1 million position; the fund has 7.3% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions include Phill Gross and Robert Atchinson’s Adage Capital Management, Matt Sirovich and Jeremy Mindich’s Scopia Capital and Joe Milano’s Greenhouse Funds.

Judging by the fact that Acuity Brands, Inc. (NYSE:AYI) has faced bearish sentiment from the entirety of the hedge funds we track, it’s easy to see that there lies a certain “tier” of money managers that elected to cut their entire stakes heading into Q3. Interestingly, Ian Simm’s Impax Asset Management dropped the biggest position of the 700 funds tracked by Insider Monkey, worth about $30.5 million in stock, and Jeffrey Talpins’s Element Capital Management was right behind this move, as the fund said goodbye to about $26.8 million worth. These moves are important to note, as aggregate hedge fund interest dropped by 8 funds heading into Q3.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as Acuity Brands, Inc. (NYSE:AYI) but similarly valued. These stocks are Cypress Semiconductor Corporation (NASDAQ:CY), Huntsman Corporation (NYSE:HUN), Woodward Inc (NASDAQ:WWD), and Alkermes Plc (NASDAQ:ALKS). This group of stocks’ market values are similar to AYI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CY | 23 | 220139 | -1 |

| HUN | 26 | 464407 | -5 |

| WWD | 14 | 193689 | 0 |

| ALKS | 19 | 175362 | 3 |

| Average | 20.5 | 263399 | -0.75 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 20.5 hedge funds with bullish positions and the average amount invested in these stocks was $263 million. That figure was $849 million in AYI’s case. Huntsman Corporation (NYSE:HUN) is the most popular stock in this table. On the other hand Woodward Inc (NASDAQ:WWD) is the least popular one with only 14 bullish hedge fund positions. Compared to these stocks Acuity Brands, Inc. (NYSE:AYI) is more popular among hedge funds. Our calculations showed that top 15 most popular stocks among hedge funds returned 24.2% through April 22nd and outperformed the S&P 500 ETF (SPY) by more than 7 percentage points. Hedge funds were also right about betting on AYI as the stock returned 25.5% and outperformed the market as well.

Disclosure: None. This article was originally published at Insider Monkey.