The Insider Monkey team has completed processing the quarterly 13F filings for the September quarter submitted by the hedge funds and other money managers included in our extensive database. Most hedge fund investors endured a torrid quarter, which certainly propelled them to adjust their equity holdings so as to maintain the desired risk profile. As a result, the relevancy of these public filings and their content is indisputable, as they may reveal numerous high-potential stocks. The following article will discuss the smart money sentiment towards 51job, Inc. (NASDAQ:JOBS).

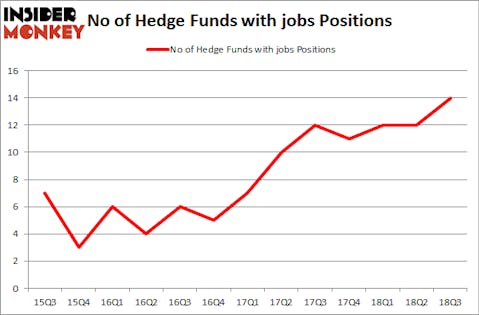

51job, Inc. (NASDAQ:JOBS) shareholders have witnessed an increase in activity from the world’s largest hedge funds recently. Our calculations also showed that jobs isn’t among the 30 most popular stocks among hedge funds.

Why do we pay any attention at all to hedge fund sentiment? Our research has shown that hedge funds’ large-cap stock picks indeed failed to beat the market between 1999 and 2016. However, we were able to identify in advance a select group of hedge fund holdings that outperformed the market by 18 percentage points since May 2014 through December 3, 2018 (see the details here). We were also able to identify in advance a select group of hedge fund holdings that’ll significantly underperform the market. We have been tracking and sharing the list of these stocks since February 2017 and they lost 24% through December 3, 2018. That’s why we believe hedge fund sentiment is an extremely useful indicator that investors should pay attention to.

Let’s review the key hedge fund action regarding 51job, Inc. (NASDAQ:JOBS).

How are hedge funds trading 51job, Inc. (NASDAQ:JOBS)?

At Q3’s end, a total of 14 of the hedge funds tracked by Insider Monkey held long positions in this stock, a change of 17% from the second quarter of 2018. By comparison, 11 hedge funds held shares or bullish call options in JOBS heading into this year. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Ernest Chow and Jonathan Howe’s Sensato Capital Management has the number one position in 51job, Inc. (NASDAQ:JOBS), worth close to $15.5 million, accounting for 2.7% of its total 13F portfolio. The second most bullish fund manager is Sloane Robinson Investment Management, led by Hugh Sloane, holding a $9.6 million position; the fund has 7% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that are bullish consist of Ken Fisher’s Fisher Asset Management, George McCabe’s Portolan Capital Management and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital.

As aggregate interest increased, some big names have jumped into 51job, Inc. (NASDAQ:JOBS) headfirst. Sloane Robinson Investment Management, managed by Hugh Sloane, established the most valuable position in 51job, Inc. (NASDAQ:JOBS). Sloane Robinson Investment Management had $9.6 million invested in the company at the end of the quarter. George McCabe’s Portolan Capital Management also made a $3.6 million investment in the stock during the quarter. The other funds with new positions in the stock are David Kowitz and Sheldon Kasowitz’s Indus Capital, Brian Ashford-Russell and Tim Woolley’s Polar Capital, and Ray Dalio’s Bridgewater Associates.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as 51job, Inc. (NASDAQ:JOBS) but similarly valued. We will take a look at Hospitality Properties Trust (NASDAQ:HPT), YY Inc (NASDAQ:YY), Casey’s General Stores, Inc. (NASDAQ:CASY), and Choice Hotels International, Inc. (NYSE:CHH). This group of stocks’ market caps match JOBS’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HPT | 16 | 86991 | 0 |

| YY | 25 | 201060 | 4 |

| CASY | 18 | 88964 | 1 |

| CHH | 18 | 276727 | 1 |

| Average | 19.25 | 163436 | 1.5 |

View table here if you experience formatting issues.

As you can see these stocks had an average of 19.25 hedge funds with bullish positions and the average amount invested in these stocks was $163 million. That figure was $46 million in JOBS’s case. YY Inc (NASDAQ:YY) is the most popular stock in this table. On the other hand Hospitality Properties Trust (NASDAQ:HPT) is the least popular one with only 16 bullish hedge fund positions. Compared to these stocks 51job, Inc. (NASDAQ:JOBS) is even less popular than HPT. Considering that hedge funds aren’t fond of this stock in relation to other companies analyzed in this article, it may be a good idea to analyze it in detail and understand why the smart money isn’t behind this stock. This isn’t necessarily bad news. Although it is possible that hedge funds may think the stock is overpriced and view the stock as a short candidate, they may not be very familiar with the bullish thesis. In either case more research is warranted.

Disclosure: None. This article was originally published at Insider Monkey.